2025/11/05 | Julia Passabom & Mariana Ramirez

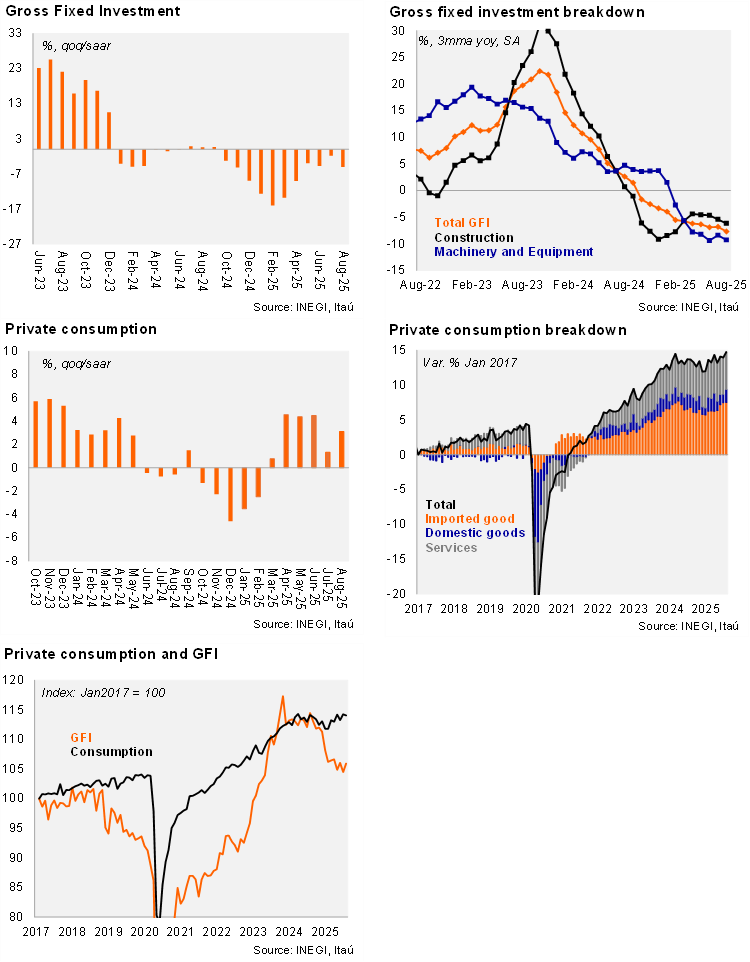

Gross Fixed Investment (GFI) fell by 10.4% YoY in August, a deeper contraction than Bloomberg’s consensus of -7.0%. By sector, machinery and equipment decreased by 13.7%, with both imported and domestic components declining. Construction fell by 7.4% YoY, with public and non-residential components also declining. Using seasonally adjusted data, investment fell by 2.7% MoM, below market expectations of -1.7%. Machinery and equipment decreased by 3.1%, and construction declined by 1.5% due to both residential and non-residential components.

Private consumption increased by 0.1% YoY, exceeding the consensus estimate of a 0.8% contraction. On a monthly basis, using seasonally adjusted data, private consumption rose by 0.6%, with domestic goods and services showing growth of 1.3% and 0.2%, respectively. Imported goods grew by 0.3%, followed by an increase of 1.7% in July, supported by the peso appreciation and preceding the increase in taxes on imported goods from countries without trade agreements.

Our view: August's domestic demand figures continued to show mixed dynamics across components, with investment being negative at -5.0% QoQ/SAAR (down from -1.9%) and private consumption positive at 3.1%, up from 1.3% in July. Looking ahead, we expect Mexico’s growth to continue receiving some support from external factors, but these will become less relevant, as seen in the first quarter of 2025. The outlook for domestically driven sectors will remain mixed, with a slowdown in local services and a contraction in investment. Investment could show some signs of improvement based on the start of public projects, such as railways construction and road maintenance. On the other hand, soft capital goods imports don’t indicate additional support for private investment ahead. We forecast 2025 GDP growth at 0.6% YoY.

See details below