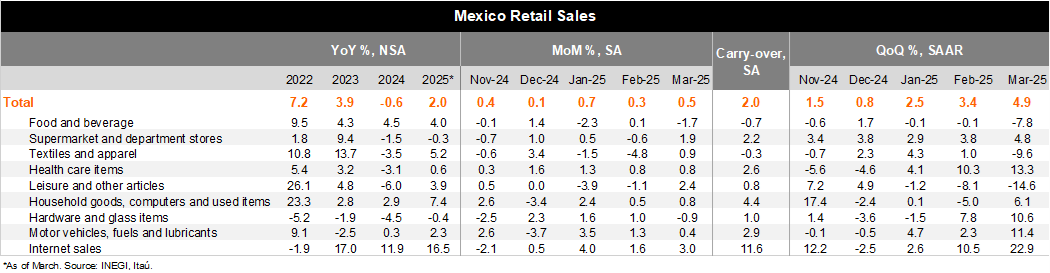

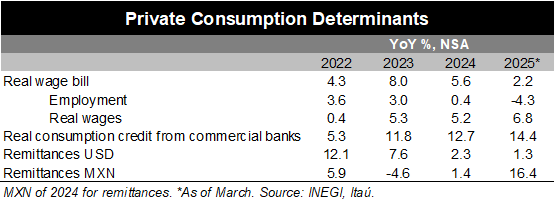

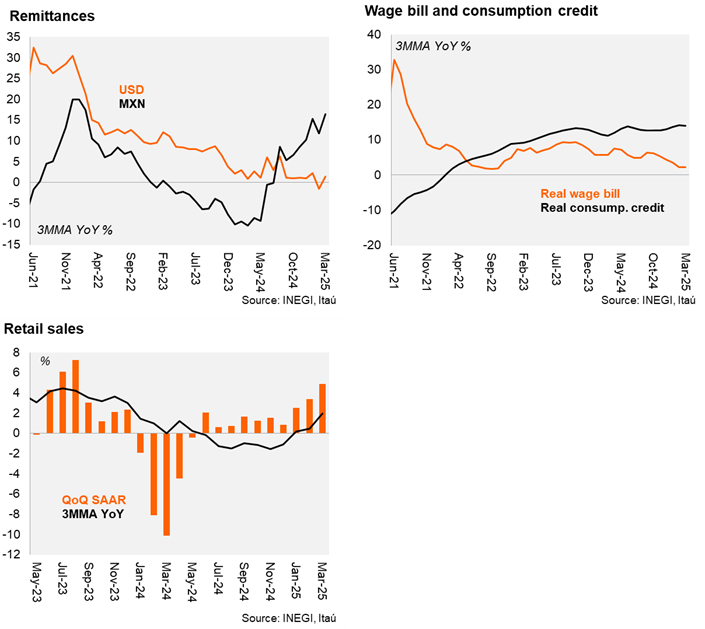

Retail sales rose 4.3% YoY in March, surprising analysts who had predicted an annual rise of 2.2%, according to the Bloomberg median. The surprise came despite the negative calendar shift during the period, as the Holy Week vacation was in March in 2024, while this year it was in April. Adjusting for this and on a monthly basis, retail sales increased by 0.5%, above the consensus forecast of 0.1%. Seven out of nine subsectors grew in March, with internet sales up by 3.0%, leisure by 2.4%, and supermarket and department stores by 1.9%. However, food and beverage, and hardware items experienced contractions of 1.7% and 0.9% MoM, respectively. The better-than-expected performance can be attributed to positive private consumption determinants that remain supportive, with the real wage bill rising by 2.2% YoY, and real consumption credit from commercial banks and remittances in MXN at 14.4% and 16.4%, respectively.

Our take: Today’s results were encouraging, reinforcing that private consumption started positively in 2025, with the QoQ/SAAR at 4.9% (up from 3.4% in the previous quarter), and a statistical carry-over of 2.0% for the year. Due to resilient consumption determinants, such as the growing real wage bill and still historically high consumer confidence, we anticipate the sector to remain slightly positive in 2025. Additionally, we expect private consumption to be the main driver for GDP growth this year, despite our GDP forecast of -0.5% YoY in 2025.