2025/09/04 | Julia Passabom & Mariana Ramirez

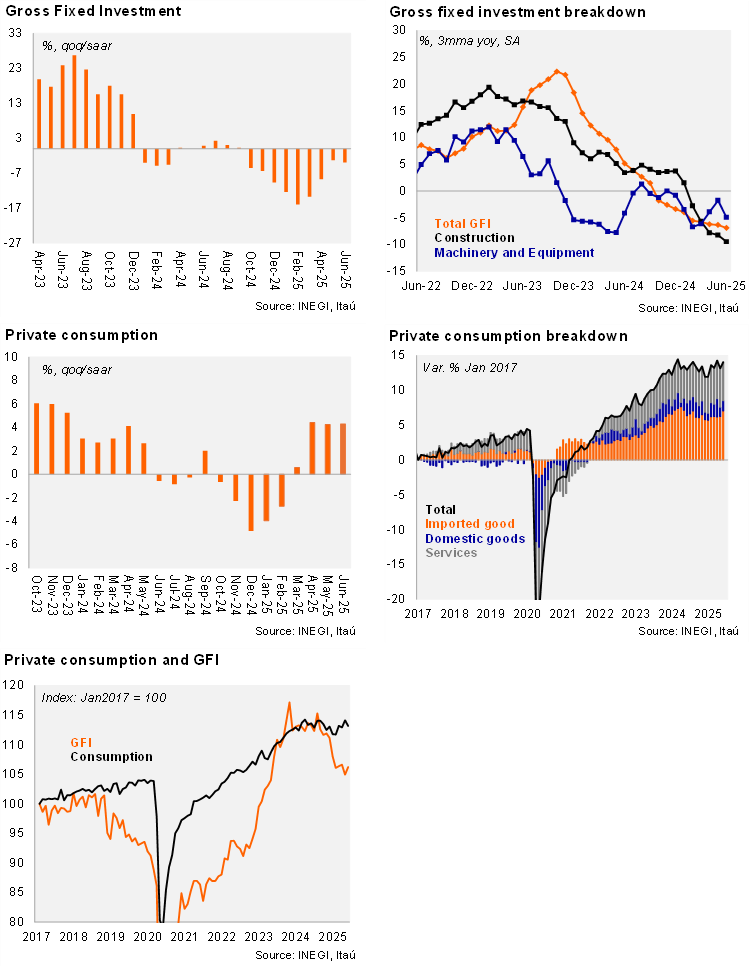

Gross Fixed Investment (GFI) fell by 6.4% YoY in June, a deeper contraction than Bloomberg’s consensus of -4.6%. By sector, machinery and equipment decreased by 9.7%, with both imported and domestic components declining. Construction fell by 3.2% YoY, with public and non-residential components also declining. Using seasonally adjusted data, investment decreased by 1.4% MoM, below market expectations of +0.1%. Machinery and equipment decreased by 1.6%, and construction declined by 0.8% due to residential construction, although non-residential construction increased.

On the other hand, private consumption rose by 1.6% YoY, exceeding the consensus estimate of +0.9%. Data from the previous month was revised upward from a fall of -1.6% to -1.1%. On a monthly basis, using seasonally adjusted data, private consumption decreased by 0.8%, with domestic goods and services showing mixed performances of +0.3% and -0.1%, respectively. However, imported goods grew by 4.9%, the highest figure since 2020, supported by the peso appreciation and preceding the increase in taxes on imported goods from countries without trade agreements.

Our view: June's domestic demand figures continued to show mixed dynamics across components, with investment being more negative at -3.9% QoQ/SAAR (down from -3.3%) and consumption slightly more positive at 4.3%, up from 4.2% in May. Looking ahead, we anticipate some support for Mexico's growth from international sources, primarily in manufacturing exports, which still exhibit some frontloading effects, and growth in the tourism sector. The outlook for domestically related sectors is mixed, however, with a moderation in local services and a contraction in investment. If trade-related policy uncertainty moderates significantly, private investment might recover faster. We maintain our 2025 GDP forecast of 0.6% YoY.

See details below