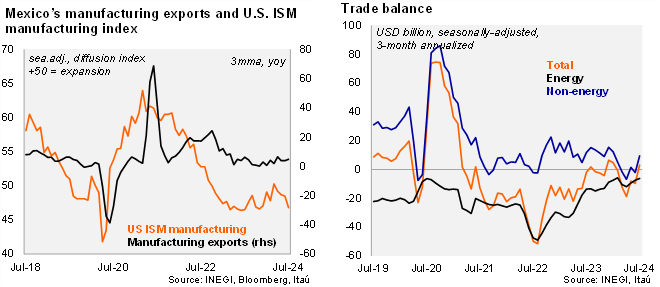

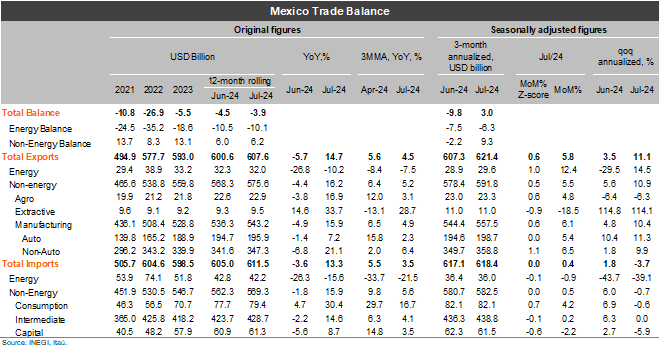

The trade balance in July surprised with a deficit of USD 0.1 billion, a smaller deficit with respect to market consensus of a deficit of USD 1.7 billion (as per Bloomberg) and our call of a deficit of USD 4.2 billion. On a 12-month rolling basis, the trade deficit reached USD 3.9 billion in July (from a deficit of USD 4.5 billion in June and a deficit of USD 5.5 billion in 2023). The result, relative to June, is explained by a wider non-energy trade surplus and a smaller energy trade deficit. At the margin, using three-month annualized seasonally adjusted figures, the trade balance stood at a surplus of USD 3.0 billion in July (from a deficit of USD 9.8 billion in 2Q24). Looking at the breakdown, manufacturing exports rebounded, expanding 6.1%, with a positive momentum (qoq/saar of 10.4%). Non-energy imports expanded at a softer pace (0.5% MoM/SA), dragged by capital imports, while private consumption expanded at a decent pace. The qoq/saar of non-energy imports stood at a soft -0.7% in July.

Our view: Our trade deficit forecast for 2024 stands at USD 10 billion. A weaker currency will bring some support to manufacturing exports during the rest of the year, although curbed by a slowdown of the U.S. economy. Weaker internal demand should curb non-energy consumption and capital imports.

See detailed data below