2025/09/11 | Julia Passabom & Mariana Ramirez

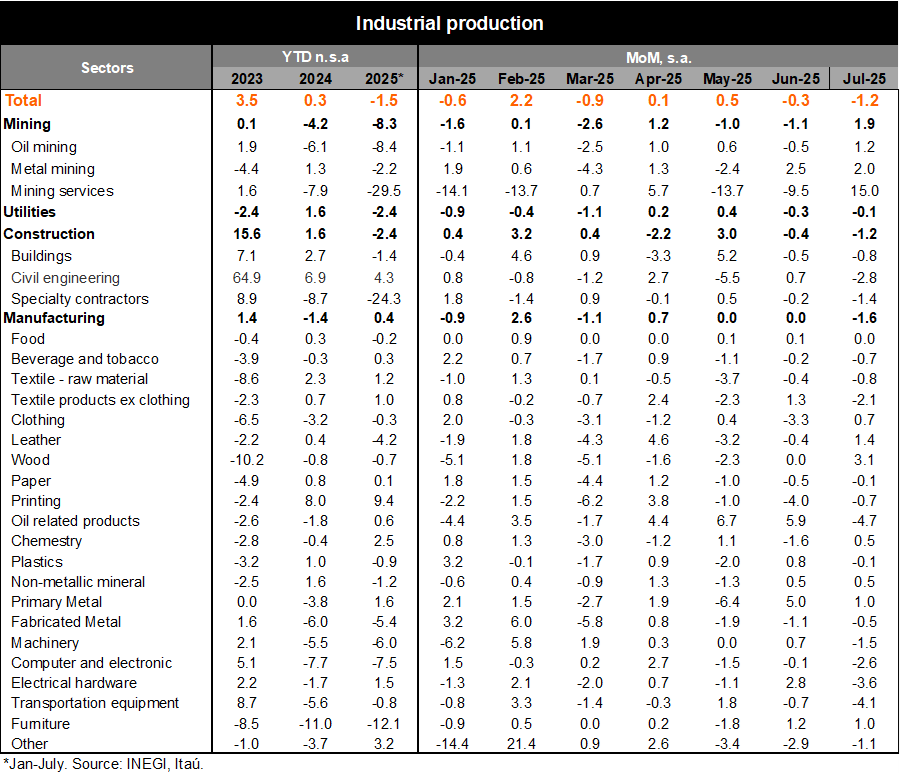

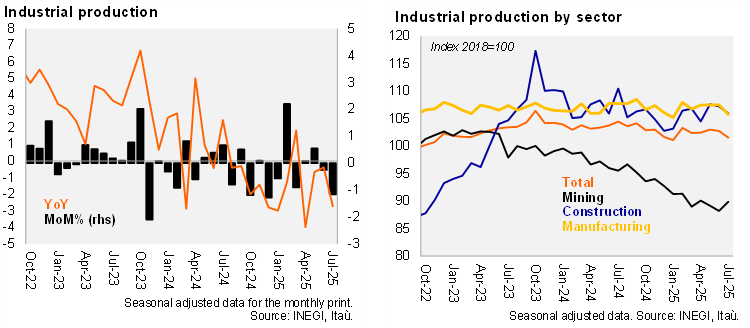

Industrial production (IP) decreased by 2.7% YoY in July, a negative surprise compared to Bloomberg’s market consensus of -0.9% and our forecast of -0.6%. The annual figures showed a broad-based contraction, with mining at -5.8%, utilities at -3.7%, construction at -3.5%, and manufacturing at -1.9%. Using seasonally adjusted figures, IP decreased by 1.2% MoM, performing worse than the consensus of -0.2%, our forecast of 0.0%, and INEGI’s nowcast of +0.1%. This performance was driven by a contraction in construction (-1.2%, with declines in all its components), manufacturing (-1.6% MoM, with 13 out of 21 subsectors decreasing, including transportation equipment), and utilities (-0.1%). Mining partially offset the decrease, growing by 1.9% due to metal and mining services.

Our take: Today's release showed a challenging start to the third quarter, with the QoQ/SAAR at -1.1% due to declines in manufacturing (-1.7%) and mining (-4.7%), despite positive performance in construction (+3.9%). Looking ahead, as we’ve mentioned in recent months, shifts in U.S. trade policy will continue to create distortions in manufacturing exports, such as temporary inventory accumulation and a reorganization of supply chains. Additionally, high uncertainty is likely to be reflected in low levels of private investment in Mexico, which should imply weak private construction and manufacturing going forward. In 2026, the first trilateral review meeting of the USMCA will be held no later than July 1, which could potentially create more uncertainty. The government is focused on strengthening domestic activity amid changes in the global outlook, which might modestly drive public construction in the second half of 2025, with projects such as railways and highways. We forecast 0.6% GDP growth in 2025.

See more details below