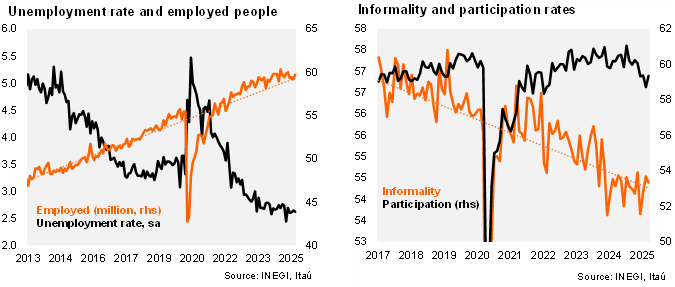

According to INEGI, the unemployment rate stood at 2.22% in non-seasonally adjusted terms in March, slightly lower than our forecast of 2.31% and Bloomberg’s market consensus of 2.35%. Using seasonally adjusted data, the unemployment rate was 2.62% in March, down from 2.65% in January and 2.69% a year ago. This decrease is mainly attributed to lower unemployment among people with fewer years of schooling and no work experience.

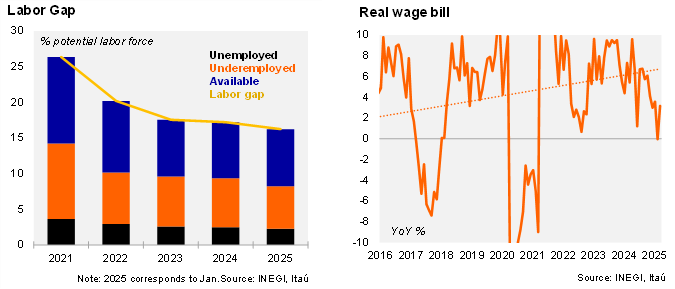

Compared to last year, the number of employed fell by 88k in March, with a contraction of 92k in the formal sector and an increase of 4k in the informal sector. This figure was affected by seasonal distortions due to different Easter holiday dates compared to 2024 (2Q25 vs. 1Q24). The labor participation rate stood at 59.3%, slightly above February’s 58.7% and higher than the pre-pandemic average for the same month, which was 59.5%. March’s informality rate remains low at 54.4% (compared to 54.5% in February) and continues to fluctuate on a downward trend. Regarding wages, the wage bill in real terms increased by 3.2% due to higher real wages during the month (+7.6% YoY), despite a 4.2% YoY contraction in the number of employed people.

Our view: Looking ahead, we anticipate that job creation will continue to decelerate, driven by the expected slowdown in economic activity. We anticipate the unemployment rate to increase to an average of 3.0% this year, compared to 2.7% in 2024. Additionally, real wage growth is expected to remain positive, partially supporting private consumption. However, there are risks due to uncertainty regarding trade policy, which could also affect the labor market.

See details below