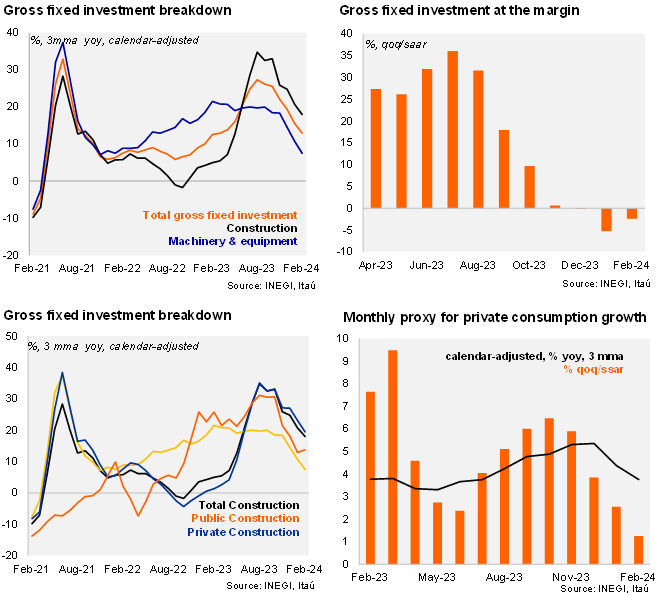

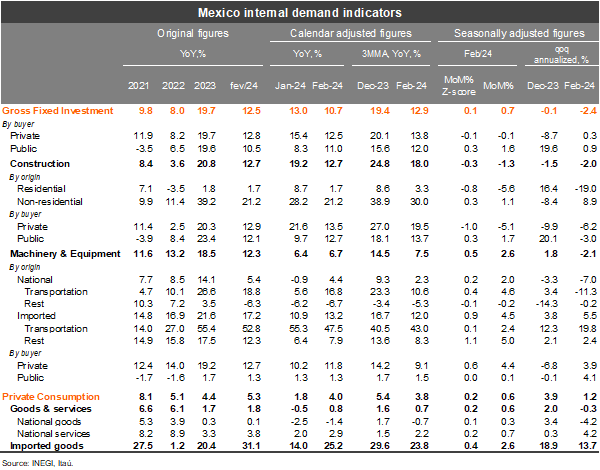

Gross Fixed Investment (GFI) expanded 12.5% yoy in February (vs. market consensus of 12.7%), while private consumption rose by 5.3% (vs. market consensus of 5.2%). The figure was partly boosted by a favorable calendar base effect (leap year). In fact, adjusting for working days, GFI grew 10.7%, taking the quarter’s annual rate to 12.9% in February (from 19.4% in 4Q23). Using seasonally adjusted series, GFI expanded 0.7% MoM/SA in February, driven by machinery and equipment investment, while investment in construction weakened (mainly from the private sector). GFI momentum was soft, with the qoq/saar at -2.4% in February. Meanwhile, private consumption expanded 0.6% MoM/SA, driven mainly by imported goods, boosted by a strong currency. The qoq/saar of private consumption stood at a still positive 1.2% in February but slowing from 3.9% in 4Q23.

Our take: The expansion of internal demand in February, in particular private consumption, is consistent with the recovery of the monthly GDP amid strong fiscal spending (concentrated in 1H24). We note the strong currency is also driving private consumption. Looking forward, we expect internal demand to soften in 2H24 as we expect some depreciation of the currency and less fiscal impulse.

See detailed data below