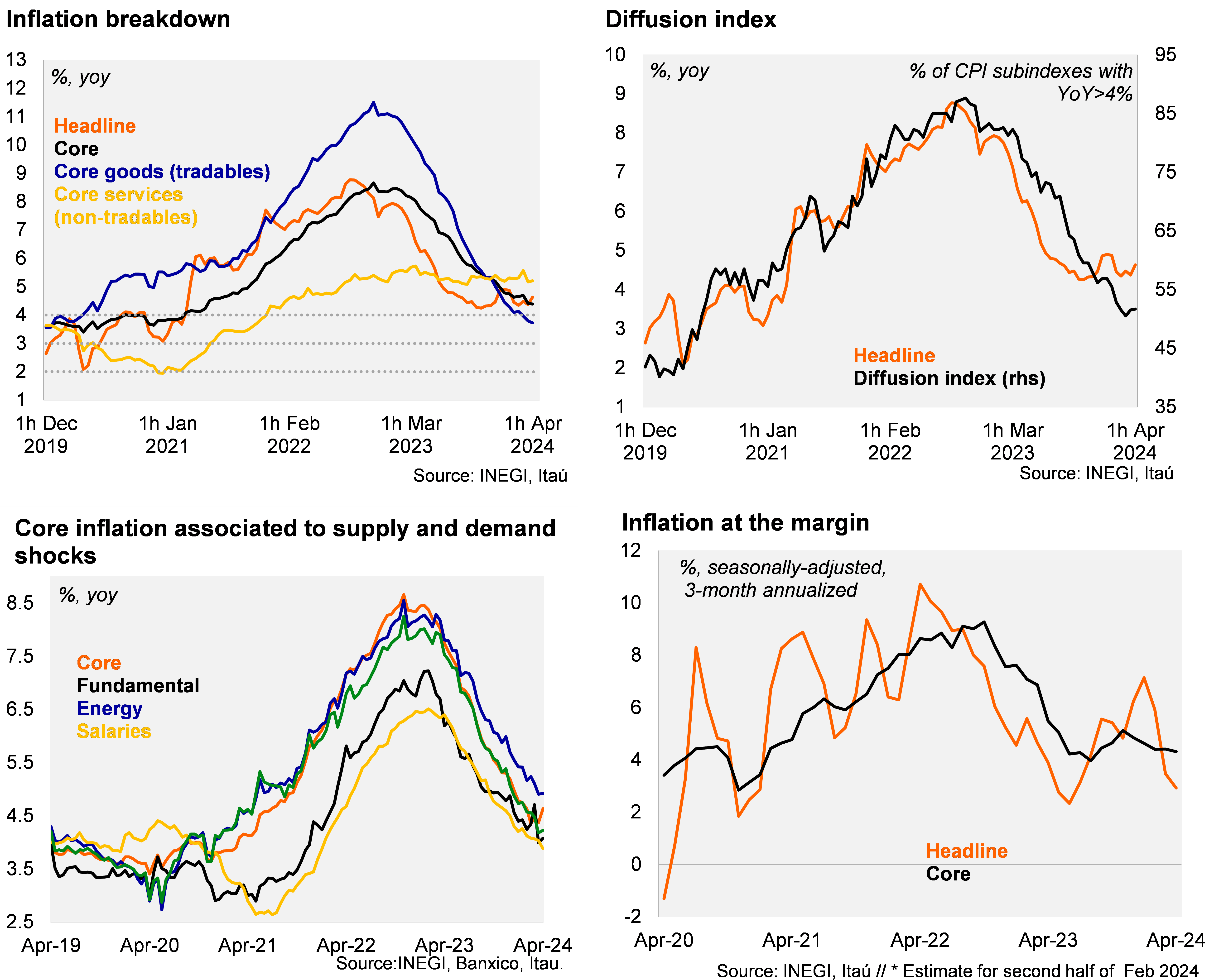

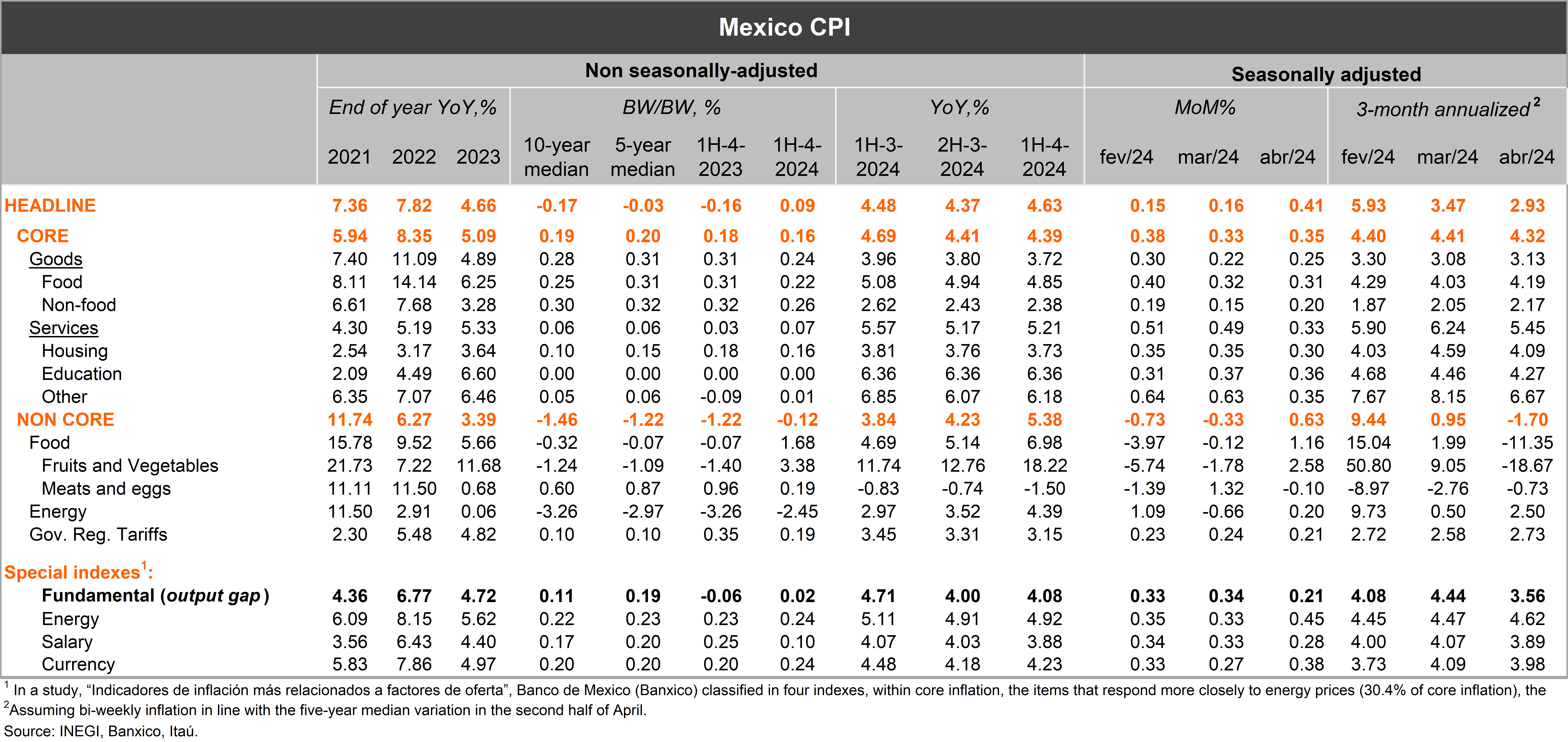

Bi-weekly headline inflation stood at 0.09%, above market consensus of -0.02% (as per Bloomberg) and our -0.06% forecast. The upside surprise, versus consensus, came mainly from the non-core index as core inflation was at 0.16%, broadly in line with market expectations of 0.15%. In the non-core index, fruits and vegetables prices rebounded and gas lp prices exerted relevant upward pressure, which was more than offset by a seasonal subsidy to electricity tariffs. Looking at core inflation, other core services index eased but not as much as we expected (0.01% versus our call of -0.25%). Said index reflects further easing of tourism related prices after easter holidays, but housing and small restaurants prices exerted relevant pressure. Other core services index excluding tourism related prices stood stable at 0.28% (from 0.33% a year ago). Core goods inflation eased further (0.24% from 0.31% a year ago). Annual headline inflation rebounded to 4.63% in 1H April (from 4.37% in 2H March), while core annual inflation fell slightly to 4.39% (from 4.41%), with services inflation accelerating to 5.21% (from 5.17%).

Our take: Overall, the most recent inflation figure is not supportive of a rate cut in the next monetary policy meeting (May 9), considering persistence in services inflation persistence. In the balance for the upcoming monetary policy meeting, we also have a strong rebound in February’s activity (mainly in services) amid strong fiscal spending and a likely delay of Fed’s start of the easing cycle. In this context, our base case remains for a pause in the next monetary policy meeting. Looking forward, we still have one more inflation print and GDP flash estimate for 1Q24, before the meeting.

See detailed data below

Julio Ruiz

|