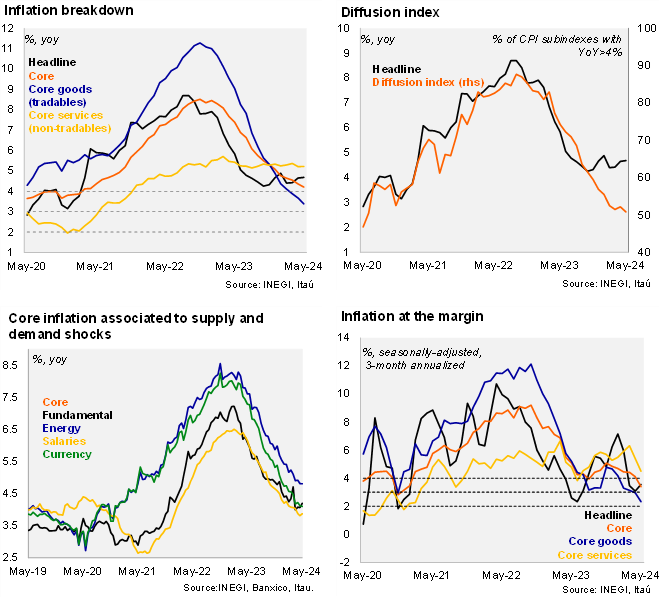

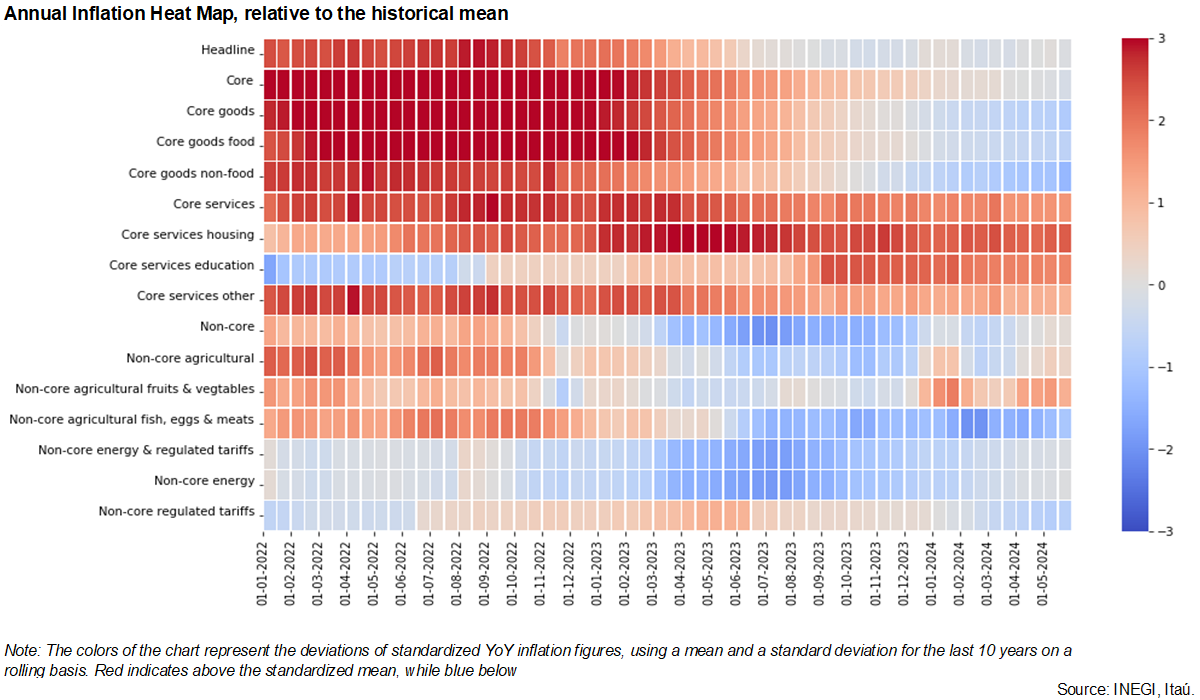

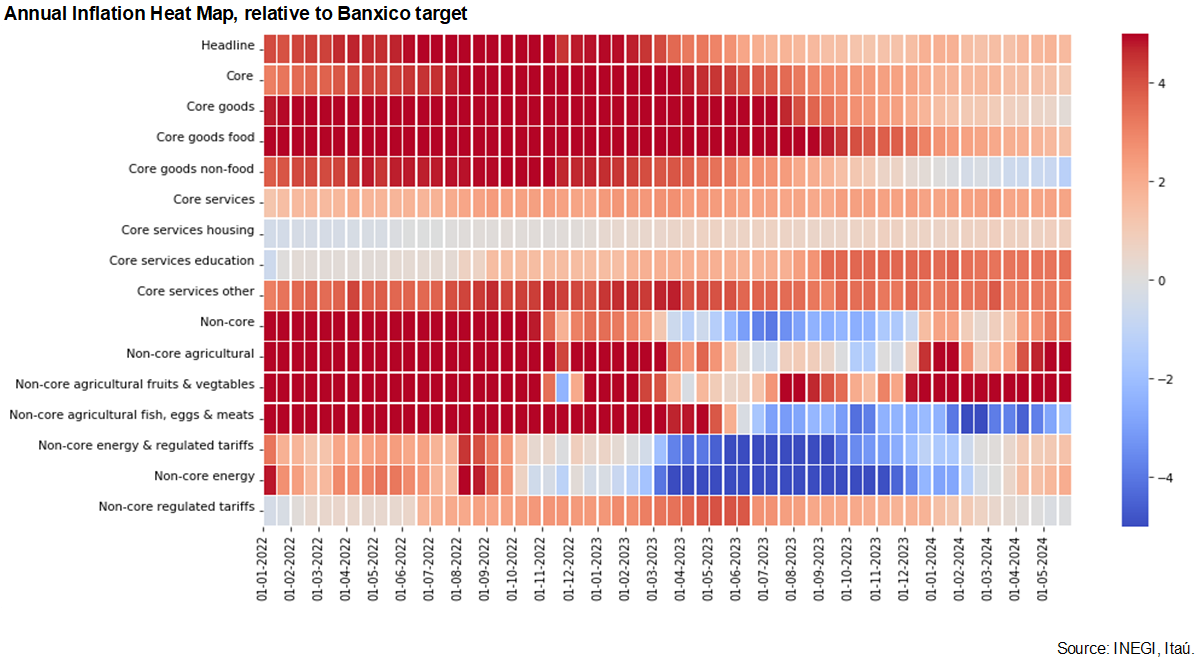

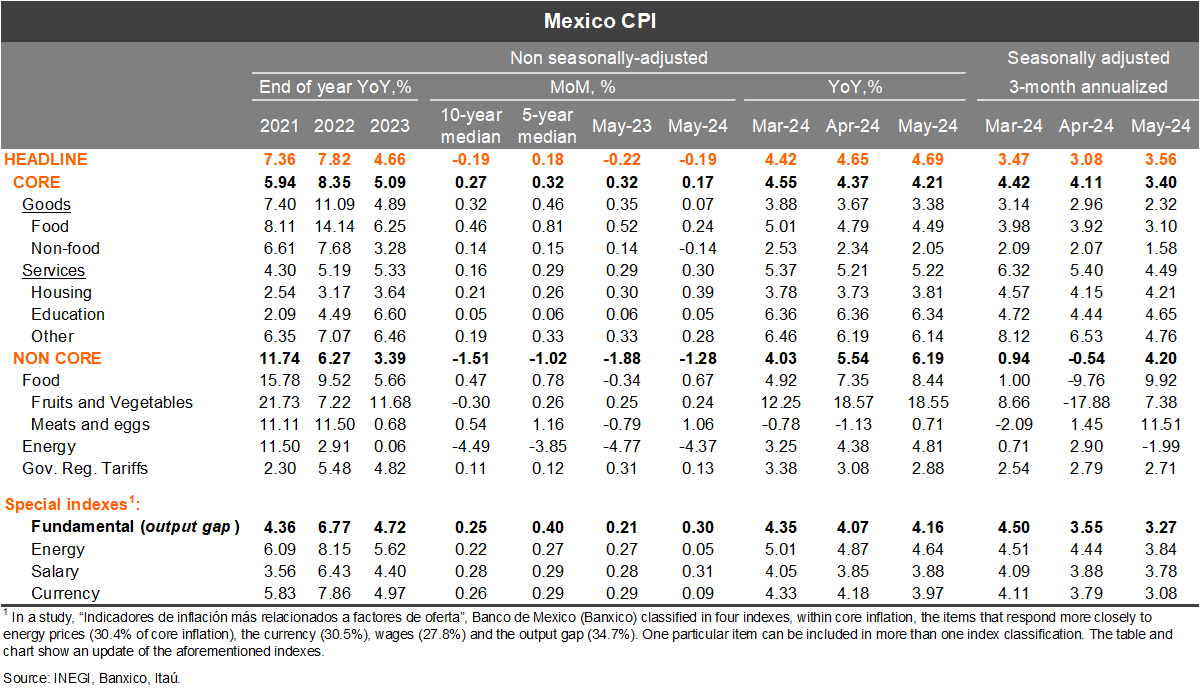

Headline CPI fell by 0.19% MoM in May, below market consensus of -0.07% (as per Bloomberg) and our forecast of -0.09%. The headline figure was pressured down by volatile fruits & vegetable prices (in the 2H of May), gas lp prices and a seasonal subsidy to electricity tariffs. Core inflation was also below market expectations (0.17% versus both our call and consensus of 0.25%). Within core inflation, the core goods index was the main drag, reaching 0.07% MoM in May (below our call of 0.19%). On an annual basis, headline inflation stood at 4.69% in May (from 4.65% in April), while core inflation fell to 4.21% (from 4.37%), but with services inflation persistent at 5.22%. We note that annual average headline and core inflation for April and May came in at 4.67% and 4.29%, respectively, which compares fairly with Banxico’s 2Q24 headline and core inflation forecasts of 4.6% and 4.3%, respectively.

Our take: Today’s inflation figures are supportive for a rate cut in the June 27 monetary policy meeting. We expect a split decision given some board members are still cautious on the inflation environment (persistence of services inflation). Our call has an upward risk depending on the persistence of uncertainty (which has pressured the currency) from the new political landscape.