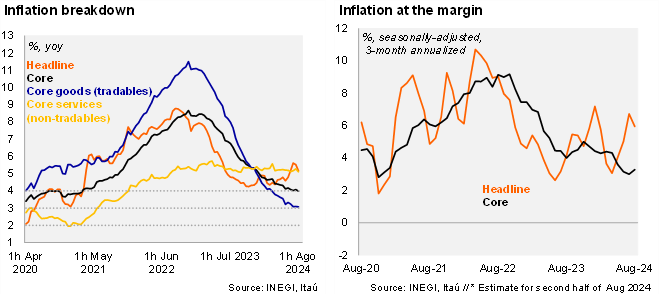

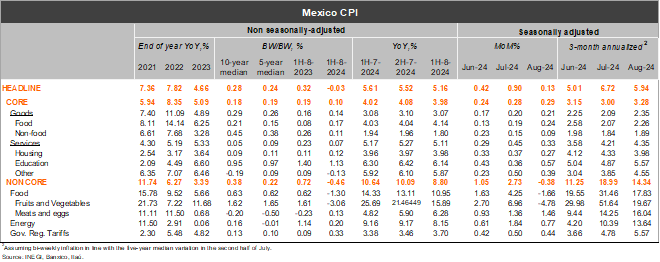

Bi-weekly headline inflation fell by 0.03%, below market consensus of +0.12% (as per Bloomberg), but closer to our call of +0.05%. Non-core inflationary pressures eased further, with fruits & vegetables falling 3.06% vs our call of -2.39%. Core inflation also surprised to the downside, reaching 0.10% vs consensus and our call – both at 0.19%. Within core inflation, we note other services inflation eased, falling by 0.13% (from 0.09% a year ago) aided by a fall in air tariffs after summer holidays while the seasonal increase in education prices was also below a year ago (1.13% versus 1.40%). On an annual basis, headline inflation fell to 5.16% in 1H August (from 5.52% in 2H July), while core inflation fell to 3.98% (from 4.08%). We note core annual inflation entered the central bank’s target range of 3+/-1%. At the margin, assuming bi-weekly inflation in line with the five-year median variation in the second half of August, the seasonally adjusted three-month annualized headline inflation measure stood at 5.94% in August (from 6.72% in July), while core inflation stood at 3.28% (from 3.00%).

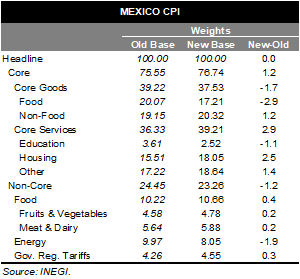

Today’s figure was published under a new base, increasing the weight of core inflation. Core inflation increased its weight by 1.2 percentages points (p.p.) relative to the non-core index. Within core inflation, services inflation gained significant weight (2.9 p.p) driven by other services and housing indexes while education lost participation. The weight of total goods was reduced by 1.7 p.p. dragged by the core food index. See table below for more detail.

Our take: All in all, today’s figure is supportive for the central bank of Mexico to continue cutting its policy rate by 25-bp in the September 26 meeting. Also considering a weaker outlook for economic activity (which could reduce board member concerns on the disinflationary process of services inflation) and high odds of the Fed starting their easing cycle in September. Our end of year policy rate stands at 10.00%.

See detailed data below