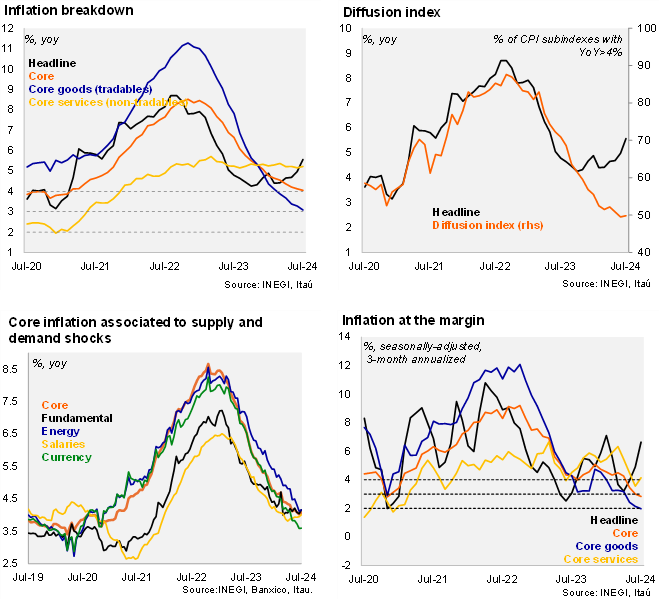

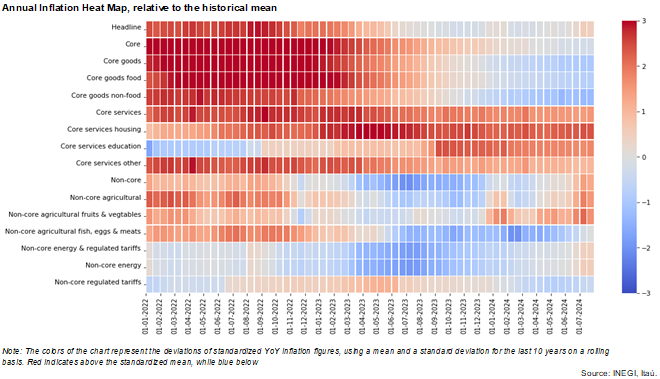

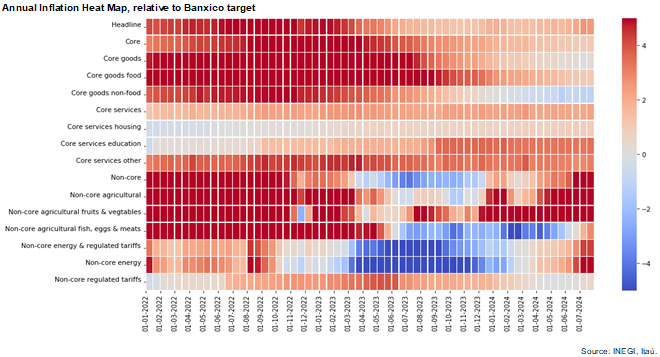

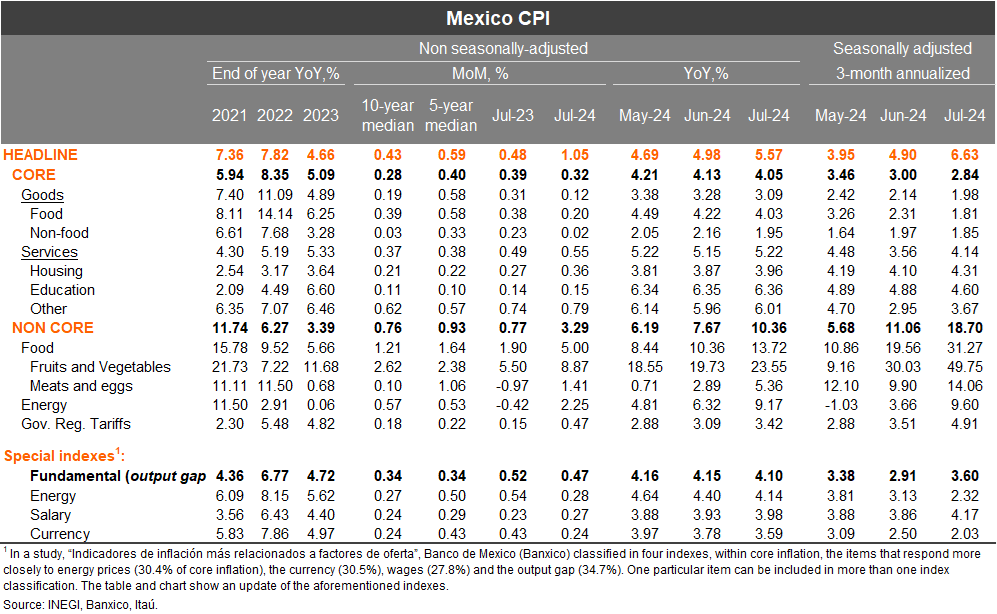

Headline CPI increased 1.05% MoM, above market expectations of 1.02% but in line with our forecast. Core inflation was also above market expectations: 0.32% vs consensus of 0.29% and our call of 0.30%. Within headline inflation, the pressure from non-core volatile fruits & vegetables prices of last prints, seems to be reversing, falling by 0.73% in the 2H of July. On an annual basis, headline inflation increased to 5.57% in July (from 4.98% in June), reflecting mainly pressure from the non-core fruits and vegetables prices in the 1H of the month as in the 2H pressures eased. In fact, headline inflation in the 2H of July fell to 5.52%, from 5.61% in 1H of July. Core inflation in July fell to 4.05% (from 4.13% in June), but with persistent core services inflation (5.22%, from 5.15%). Finally, the seasonally adjusted 3-month annualized headline inflation metric came in at 6.63% in July (from 4.90% in June), while core inflation fell to 2.84% (3.00%).

Our take: The reversal of volatile fruits & vegetables prices and the low core inflationary gap (although services inflation remained persistent) relative to the monetary restrictive stance should be supportive for Banxico to cut rates later today. Weaker than expected domestic activity outlook, which could be exacerbated if the U.S. economy deteriorates, and higher odds of the Fed cutting rates several times this year are also conducive for a Banxico rate cut. However, the recent sharp depreciation/volatility of the currency is a relevant risk for extending the pause which Banxico board will have to balance in their decision today. Our base scenario is for a 25-bp rate cut. On another note, today’s press release announced that starting on August 22nd the statistics institute will start publishing the CPI index under a new base.