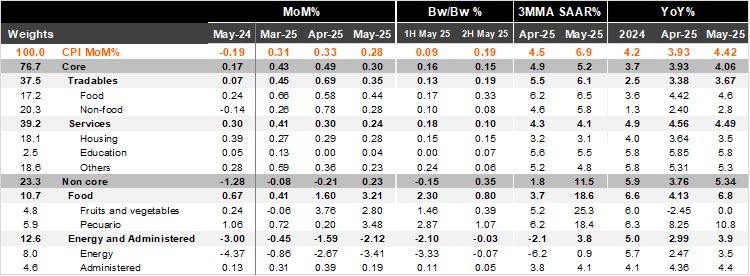

Bi-weekly headline CPI for the second half of May was 0.19%, above Bloomberg’s market consensus and our forecast (0.11% and 0.07%, respectively). Core inflation came in at 0.15%, above expectations and our forecast (0.10% and 0.12%, respectively). Within the core component, tradable prices rose by 0.19% 2w/2w, up from 0.13% in the previous fortnight. Services prices rose by 0.10% 2w/2w, lower than the previous data (0.18%), due to “other services” category -particularly tourism and professional services- The non-core component increased by 0.35% 2w/2w due to food prices, which increased during the fortnight (0.80%) due to adverse weather conditions across the country.

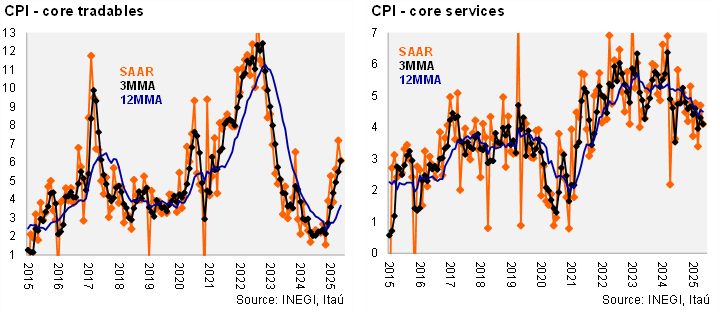

In annual terms, headline inflation accelerated to 4.42%, from 3.93% in April. Core CPI also increased, rising from 3.93% in the previous month figure to 4.06% now, with goods at 3.67% (up from 3.38%) and services at 4.49% (down from 4.56%). In the May 15 statement, Banxico forecasted 3.9% for both headline and core inflation during 2Q25, well below today’s data. Core measures remain under pressure at the margin: core CPI 5.2% 3MMA SAAR (tradables 6.1% and services 4.1%).

Our take: Today’s report reinforces our view that the disinflation process has already occurred, and headline inflation is projected to oscillate around the ceiling of Banxico’s inflation target tolerance range, down from nearly 9% at its peak in 2022. Most of the disinflation came from non-core items, while core goods inflation continues to accelerate at the margin, and core services remain sticky in a still tight labor market scenario. We forecast CPI to end 2025 at 3.9%. Regarding the policy rate, we maintain our call for a 50-bps rate cut in June, down to 8.0%.

See details below