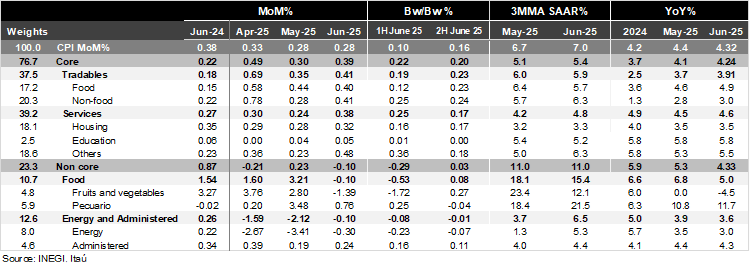

Bi-weekly headline CPI for the second half of June was 0.16%, above Bloomberg’s market consensus of 0.13% and our forecast of 0.12%. Core inflation came in at 0.20%, above both market’s expectations and our forecast at 0.14%. Within the core component, tradable prices rose by 0.23% 2w/2w, above the previous fortnight at 0.19%. Services prices increased by 0.17% 2w/2w, down from the previous data of 0.25%, with pressures from housing and restaurants. The non-core component increased by 0.03% 2w/2w due to a pressure in fruit and vegetable prices, which rose by 0.27% during the fortnight in items such as onions and zucchinis.

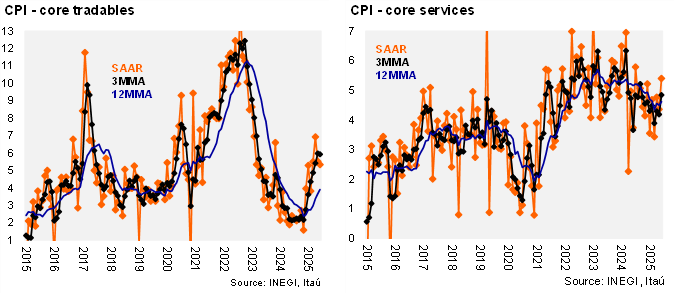

In annual terms, headline inflation decelerated to 4.32% from 4.42% in May but remains above the 4% threshold. Core CPI increased, rising from 4.06% in the previous month figure to 4.24% now, with tradables at 3.91% (up from 3.67%) and services at 4.62% (up from 4.49%). In the June 26 monetary policy statement, Banxico forecasted 4.3% for headline and 4.1% for core inflation during 2Q25, slightly above headline at 4.22%, and in line with core at 4.08%. Core measures remain under pressure at the margin: core CPI is at 5.4% 3MMA SAAR (tradables at 5.9% and services at 4.8%).Within services, other services and housing components were the main drivers for the acceleration at the margin.

Our take: Today’s report reinforces our view that the disinflation process has already occurred, with headline inflation projected to oscillate around the ceiling of Banxico’s inflation target tolerance range, down from nearly 9% at its peak in 2022. Most of the disinflation resulted from non-core items, while core goods inflation continues to accelerate at the margin, and core services remain sticky in the context of a still-tight labor market. We forecast CPI to end 2025 at 3.9% with an upside bias, given recent inflation dynamics and some short-term upward surprises. Regarding the policy rate, we maintain our call for a 25-bps rate cut at the August 7 meeting, bringing it down to 7.75%. Banxico may cut further, conditional on inflation dynamics and the Fed. We expect only one 25-bp cut by the Fed this year, in December.

See details below