2025/12/23 | Julia Passabom, Mariana Ramirez & Ignacio Martínez

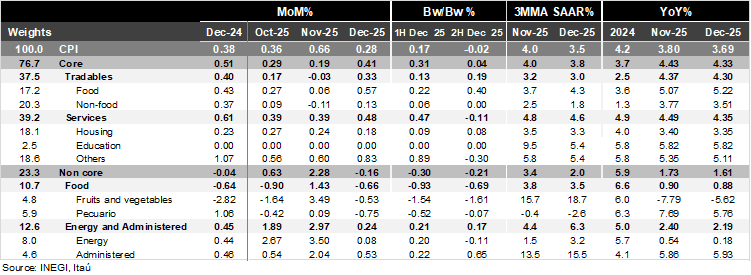

Bi-weekly headline CPI for the second half of December fell by 0.02% 2w/2w, below Bloomberg’s market consensus (+0.08%) and our forecast (+0.17%). Core inflation came in at 0.04%, also below market expectations (0.07%), but closer to our forecast (0.02%). Within core, tradables rose 0.19% 2w/2w, while core services declined by 0.11% 2w/2s, with housing rising by 0.08%, education flat, but with other services (-0.3%) leading the negative result. The non-core component contracted 0.21% 2w/2w, driven by significant drops in agricultural prices, particularly fruits and vegetables (-1.61%).

As a result, December headline and core CPI registered a monthly advance of 0.28% and 0.41%, both measures below BBG market consensus of 0.33% and 0.42% respectively.

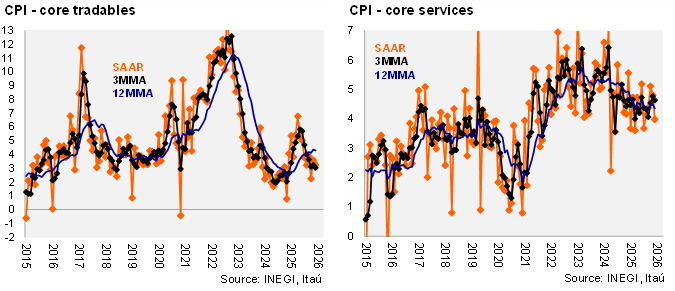

In annual terms headline inflation ended 2025 at 3.7%, ending the year within Banxico’s 3+/-1% inflation target for the first time since 2020 (3.2%). Core CPI reached 4.3%, down 0.13pp. from November, with tradables at 4.3% (down from 4.37%) and services at 4.4% (down from 4.49%). At the margin, 4Q25 headline inflation presented a 3.5% 3MMA SAAR, decreasing from the 4.0% seen in the November quarter, while Core CPI registered a 3.8% (down from 4.0%), with tradables and services decreasing from 3.2% and 4.8% to 3.0% and 4.6% respectively.

Our take: While today’s downside surprise is welcome, it was primarily led by the non-core component, in the context of a gradual deceleration of core services at the margin. We estimate that inflation was slightly above Banxico’s inflation forecasts, suggesting these may be revised in the February 5 meeting. We maintain our call of a 25bp cut to a terminal rate of 6.75% in February.