2026/02/09 | Julia Passabom, Mariana Ramirez & Ignacio Martínez

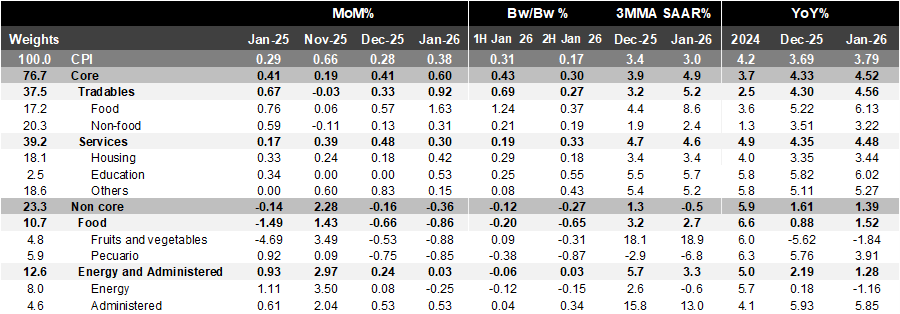

Bi-weekly headline CPI for the second half of January rose by 0.17% 2w/2w, below Bloomberg’s median (0.22%) and our forecast (0.24%). However, core inflation came in at 0.30%, somewhat higher than market expectations (0.28%) and our forecast (0.26%). Within core, tradables rose 0.19% 2w/2w, while core services declined by 0.11% 2w/2w, with housing rising by 0.08%, education flat, but with other services (-0.3%) leading the negative result. The non-core component contracted 0.21% 2w/2w, driven by significant drops in agricultural prices, particularly fruits and vegetables (-1.61%).

As a result, January headline and core CPI registered a monthly advance of 0.38% and 0.61%, repeating the behavior of a downside surprise for headline (BBG: 0.41%) and an upside surprise for Core (0.59%).

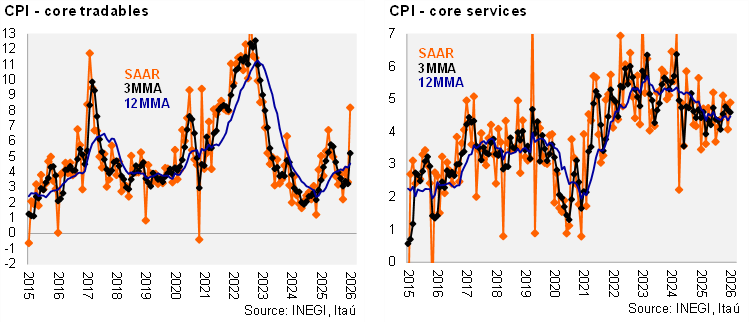

In annual terms, headline inflation started the year edging up to 3.8%, from 3.7% in December. Core CPI reached 4.5%, up 0.19pp. from December, with tradables at 4.6% (down from 4.3%) and services at 4.5% (up from 4.4%). At the margin, inflation in the quarter ending in January fell to 3% 3MMA SAAR, from the 3.5% in 4Q25, while core CPI increased to 4.9% (from 3.9%), driven mainly by tradables (5.2%; up from 3.2% in 4Q25), an expected result derived from the increase in excise taxes and tariffs seen this month. Services slightly decreased to 4.6% from 4.7%, but still presenting higher dynamics at the margin.

Our take: January inflation was contaminated by excise taxes and tariffs, which Banxico believes to be transitory. The momentum of core services remains a concern at the margin, remaining above the tolerance range’s ceiling for the past few months. While our base case is for Banxico to deliver a 25bps cut to 6.75% in the May meeting, a string of benign inflation prints prior to the March 26th decision could pave the way for an earlier cut.