2025/10/23 | Julia Passabom & Mariana Ramirez

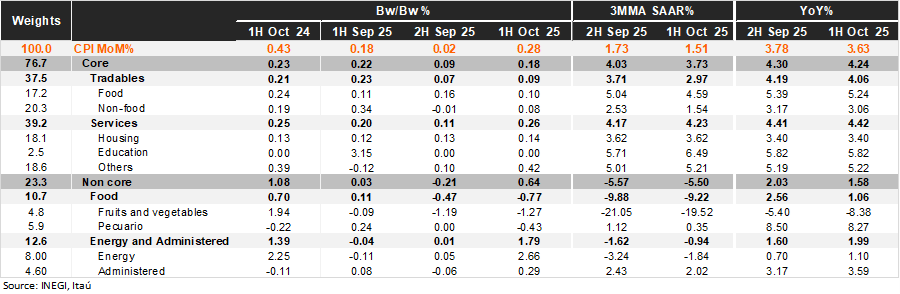

Bi-weekly headline CPI for the first half of October was 0.28%, lower than Bloomberg’s market consensus and our forecast (0.38% and 0.36%, respectively). Core inflation came in at 0.18%, slightly below the market's expectations of 0.21% and our forecast of 0.23%. Within the core component, tradable prices rose by 0.09% 2w/2w, slightly up from the previous fortnight's 0.07% due to inflation in food merchandise. Services prices increased by 0.26% 2w/2w, up from the previous data of 0.11% driven by housing and other services (air transportation, touristic services, restaurants, and professional services). The non-core component increased by 0.64% 2w/2w due to rises in electricity tariffs, as summer subsidies expired, as well as higher energy prices. However, agricultural prices decreased due to deflation in livestock (-0.43%), and fruits and vegetables (-1.27%).

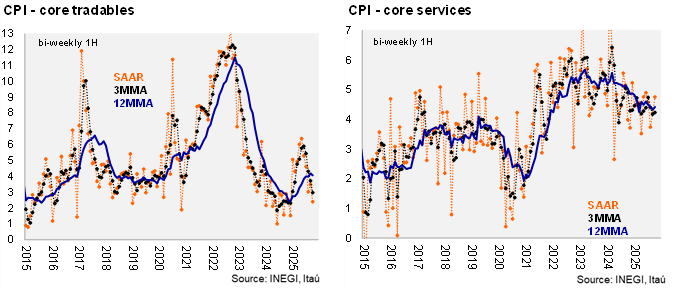

In annual terms, headline inflation was at 3.63% in 1H October, remaining below the 4% threshold since the second half of April. Core CPI was relatively stable, moving slightly down to 4.24%, with tradables at 4.06% (down from 4.19%) and services at 4.42% (slightly down from 4.41%). Core measures continued to show a significant relief: core CPI is at 3.73% 3MMA SAAR, with tradables at 2.97% and services at 4.23%. Within services, pressure continued in other service categories (5.21%).

Our take: Today’s report continues to show improvements in core inflation dynamics in the first half of October, which is considerably better at the margin and below the 4% threshold. We forecast the CPI to end 2025 at 4.1% and 2026 at 3.7%. Regarding monetary policy, our current scenario anticipates another 25-bp cut in November to 7.25%. Barring any shocks, the current dynamics -strong USDMXN and an overall declining CPI trajectory- remain in place, and in the context of a widening negative output gap, Banxico is likely to maintain its forward guidance (plural) in November as well, pointing towards an extension of the cycle into 2026. We expect the monetary policy rate to be 7.0% in 2025 and 6.5% in 2026, with consecutive cuts.

See details below