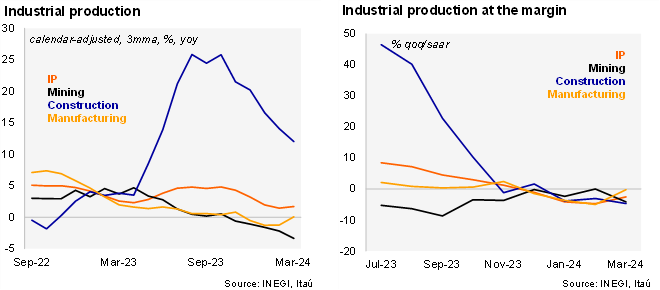

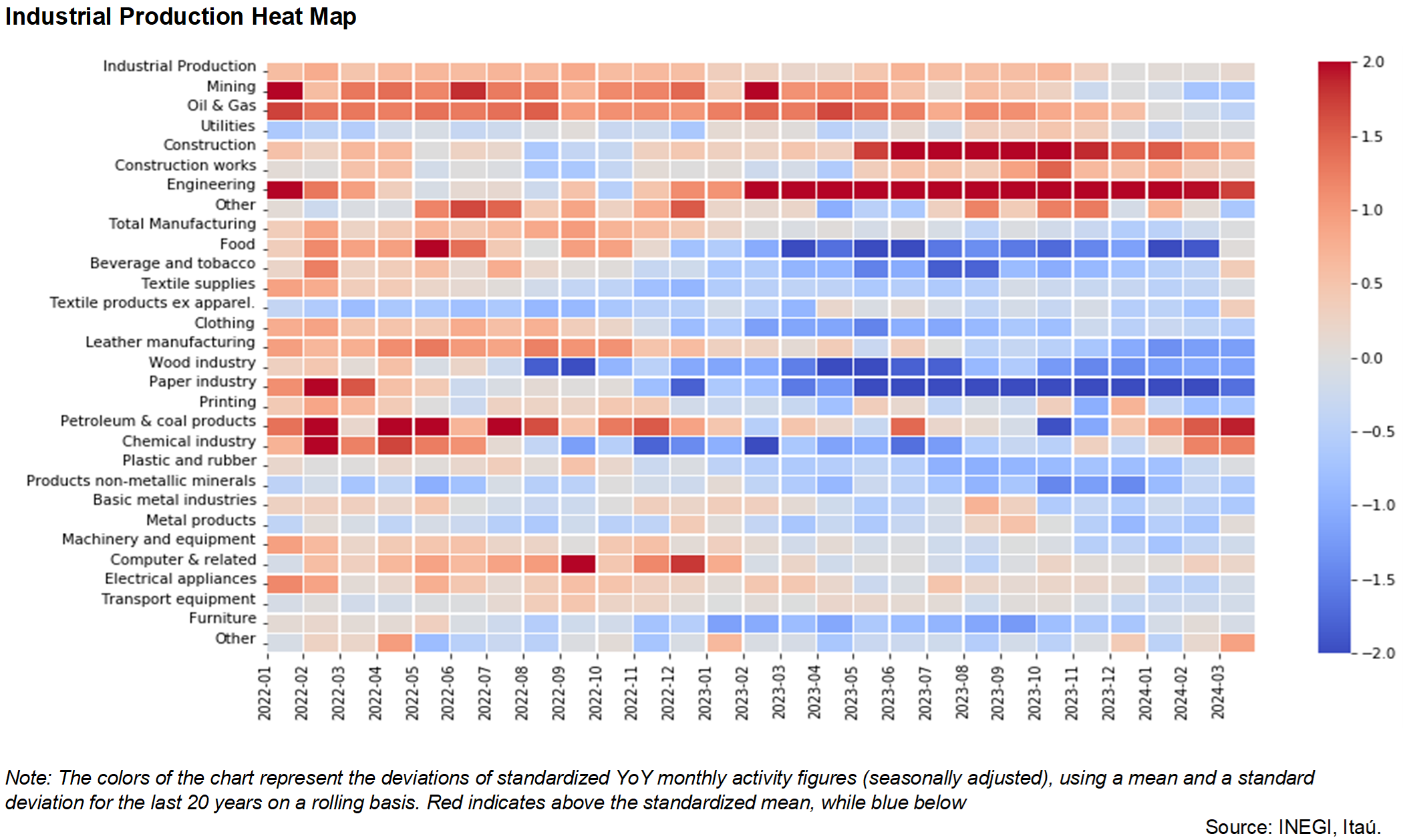

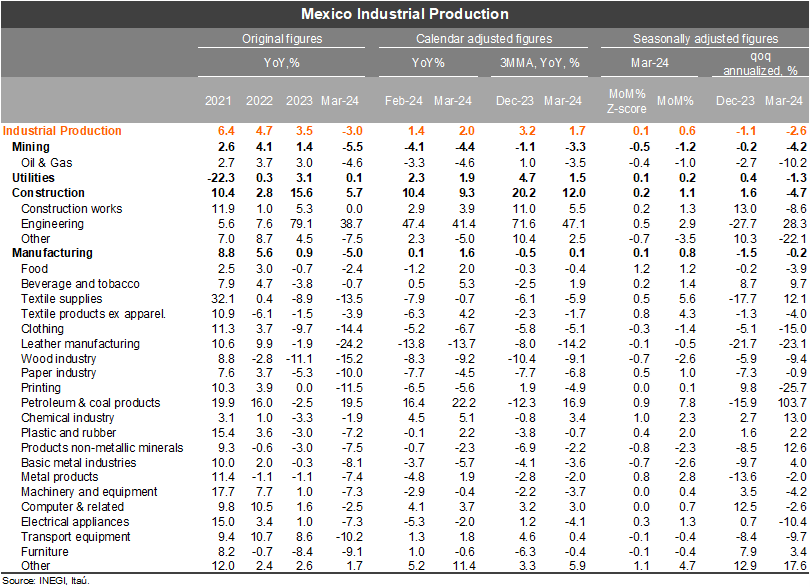

Industrial production (IP) fell by 3.0% YoY, in line with our forecast and broadly in line with market expectations of -2.9% (as per Bloomberg). The annual figure was dragged by an unfavorable calendar base effect due to Easter holidays. In fact, the calendar adjusted figure stood at a positive 2.0% YoY, taking the 1Q24 annual rate to 1.7% (from 3.2% in 4Q23). At the margin, IP expanded at a decent pace of 0.6% MoM/SA in March supported mainly by the construction sector (1.1%) likely reflecting strong fiscal spending as of 1Q24, while manufacturing output grew 0.8%. Still, momentum in IP was weak in 1Q24, with the qoq/saar at -2.6% (from -1.1% in 4Q23).

Our take: IP data confirms the soft flash GDP estimate from 1Q24 (0.2% qoq/sa) was mainly due to a weak print in January, but monthly activity in February and March are expanding at a resilient pace. Still, given said soft GDP 1Q24 our GDP growth forecast of 2.8% for 2024 has a downside bias.

See detailed data below