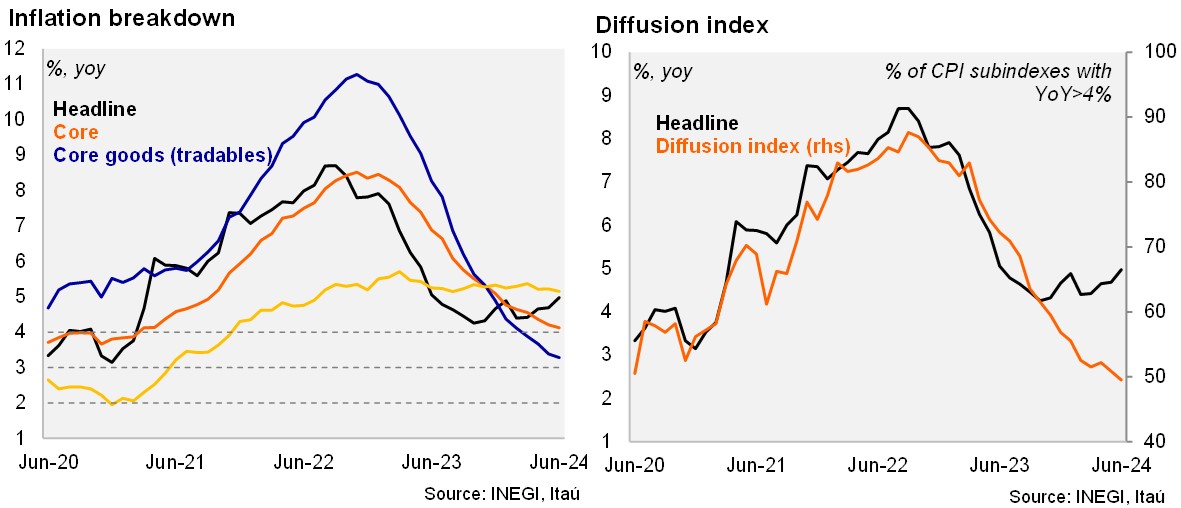

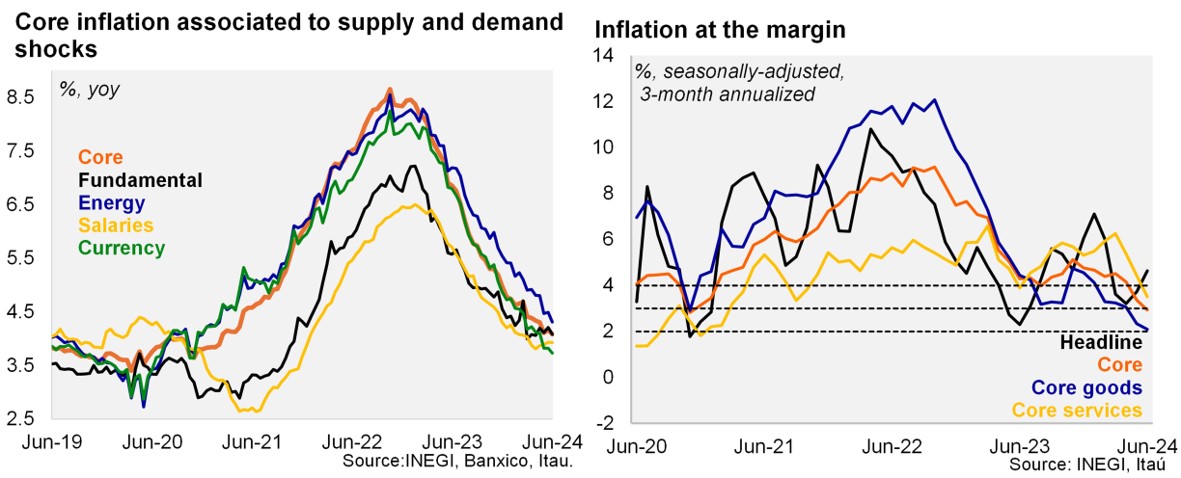

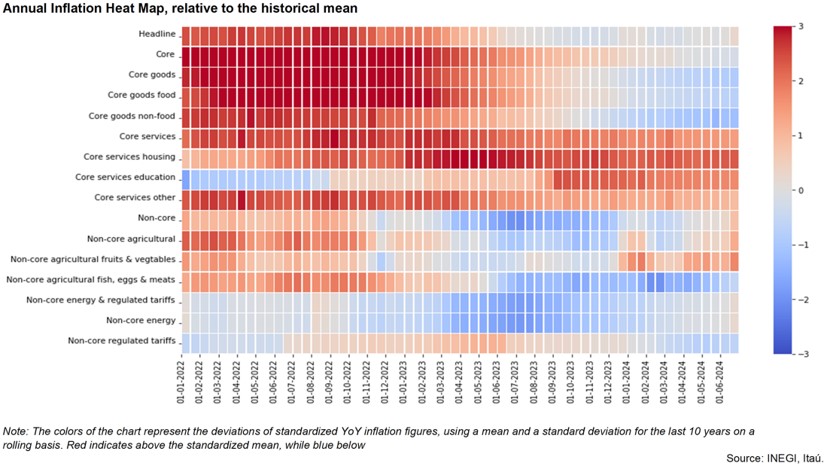

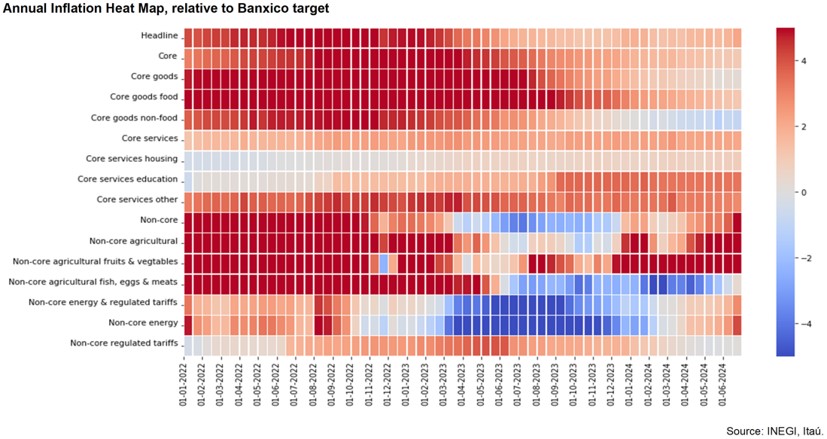

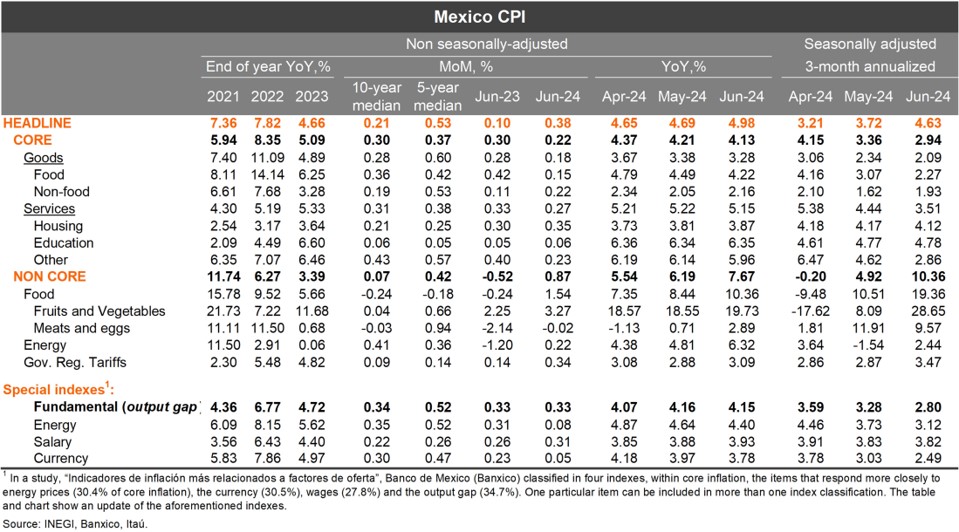

Headline CPI increased 0.38% MoM, above market expectations of 0.29% but broadly in line with our forecast of 0.36%. The main upside pressure was explained by volatile non-core agricultural prices (3.27% versus our call of 2.32%). Core inflation was broadly in line with market expectations (0.22% versus consensus of 0.23% and out call of 0.28%). On an annual basis, headline inflation rebounded to 4.98% in June (from 4.69% in May), driven by the non-core volatile index, while core inflation eased to 4.13% (from 4.21%). Within core inflation, we note both core goods (3.28%, from 3.38%) and services (5.15%, from 5.22%) inflation indexes fell on an annual basis. Finally, the seasonally adjusted 3-month annualized headline inflation metric came in at 4.63% in June (from 3.72% in May), while core inflation fell to 2.94% (3.36%).

Our take: While headline inflation rebounded in June, the annual increase was mainly due to volatile non-core prices, which should revert relatively quickly. Importantly, core inflation (including the services index) eased further. In this context and considering the restrictive level of monetary policy relative to the lower inflationary gap, our base case is for Banxico to cut its policy rate by 25-bp in the August meeting. The most recent monetary policy statement which had a dovish tone also supports our call, although we note bouts of volatility or sudden risk aversion eventually triggered by domestic policy uncertainty could lead to another pause. Monetary policy meeting minutes to be published this Thursday should shed light on the willingness of Board members to resume the easing cycle, while there are two more inflation prints before the Augst 8 monetary policy meeting.