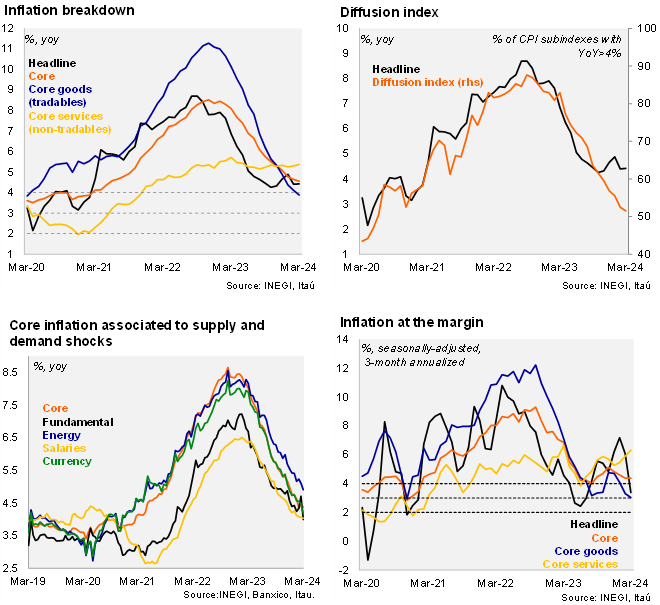

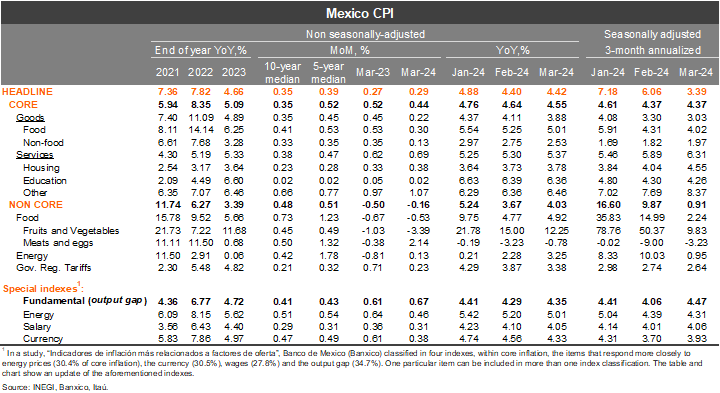

Headline CPI increased 0.29% mom in March, below our forecast of 0.32% and market consensus of 0.36% (as per Bloomberg). The downside surprise was driven by the core index which increased 0.44% vs (consensus of 0.51% and our call of 0.48%). The lower-than-expected core inflation print was more evident in the 2H of March (0.02% bw/bw vs consensus of 0.17% and our call of 0.11%), reflecting the easing of tourism related prices in the other services index (-0.13% vs our call of 0.02%) after a relevant uptick in the first half of the month inflation due to Easter holidays. On the non-core index in March, agricultural prices continued exerting downward pressure (-0.53% mom). On an annual basis, headline inflation stood at 4.42% in March (practically unchanged from the February print), while core inflation fell to 4.55% (from 4.64%). We note that there is also a relevant easing on annual basis in the 2H of March, particularly in core inflation. Core annual inflation fell to 4.41% in 2H March (from 4.69% in 1H March), driven mainly by services inflation (5.17%, from 5.57%).

Our take:Today’s inflation figures, particularly in the 2H March, support our call for the central bank to cut its policy rate by 25-bp in May (our base case), also considering soft activity at the beginning of the year despite strong fiscal spending. However, increased uncertainty surrounding the start of Fed’s easing cycle is a risk to our call. Looking forward we will have two more inflation prints before the May 9 monetary policy meeting. We note that it is likely that we continue to see downside pressure in the 1H April inflation figure from tourism related prices, considering historical patterns.