2025/09/09 | Julia Passabom & Mariana Ramirez

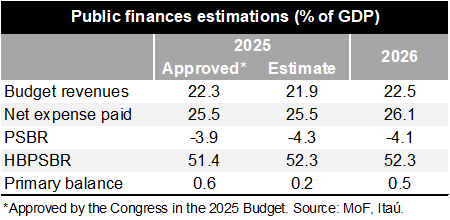

The Ministry of Finance (MoF) presented the 2026 Budget to Congress, outlining fiscal consolidation while emphasizing the execution of social programs and promoting productive investment. The Public Sector Borrowing Requirements (PSBR) was forecasted at a deficit of 4.1% of GDP, compared to the 2025 deficit estimate of 4.3% and 3.5% in the 2026 pre-budget. The primary balance was forecasted at a surplus of 0.5% of GDP, up from an estimated surplus of 0.2% of GDP in 2025, respectively.

The slightly lower nominal fiscal deficit target for next year, compared to 2025, is mainly driven by higher revenues despite an increase in net expenses. Total expenditure is estimated at 26.1% of GDP for 2026, up from 25.5% of GDP in 2025, and is concentrated in infrastructure projects aimed at expanding national productive capacity. It also focuses on strengthening effective access to constitutional social rights through social programs. The budget includes USD 14.1 billion to cover Pemex’s expenses in 2026, supporting the company's activities and contributing to strengthening its financial situation. Total fiscal revenues for 2026 are estimated at 22.5% of GDP, up from 21.9% of GDP in 2025. This increase is mainly due to the strengthening of tax collection efficiency by prioritizing the use of digital tools that facilitate compliance, simplifying procedures, and modernizing customs, while intensifying the fight against smuggling and tax evasion. Notable areas within the revenue policy include the non-deductibility of three-quarters of the contributions paid to the IPAB by multiple banking institutions and the increase in taxes on sugar drinks and tobacco.

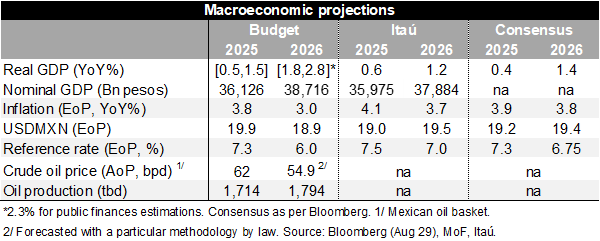

Macro assumptions overall seem reasonable, except for an above-consensus GDP growth forecast for next year (2.3% versus 1.4%). According to MoF’s sensitivities, a decrease of half a percentage in real economic growth implies a reduction in tax revenues by MXN 29.4 billion (around 0.07% of GDP). However, the lower projected oil price (54.9 bdp vs. 61.4 bdp for WTI futures) could partially offset the reduced tax revenues.

Public debt is stable in the medium term. The broadest measure of debt, the historical balance of public sector borrowing requirements, is expected to remain at 52.3% of GDP in 2026 and stabilize thereafter. Primary fiscal surpluses are anticipated for the remainder of the administration.

Regarding the legal process for approving the budget, the House of Representatives has until October 20 to approve or reject the Federal Revenue Law and pass it to the Senate, which has until the end of October to approve it. Meanwhile, the House of Representatives has until mid-November to approve the federal expenditure budget. Once approved, the final budget should be published in the Official Gazette within 20 days. In summary, Congress must approve the budget before the end of December, with any modifications accepted in due time and form, and it will come into effect on January 1.

Our take: Considering the 2026 budget, our current forecast shows a negative bias for 2025, with a nominal deficit and a primary surplus of 4.0% and 0.6% of GDP, respectively. For 2026, we expect a larger nominal deficit compared to our current scenario of 3.5%. We believe that the income measures presented in the budget to increase tax collection are positive, though ambitious and less feasible in the medium term. Additional revenue-enhancing measures may be needed in the future.