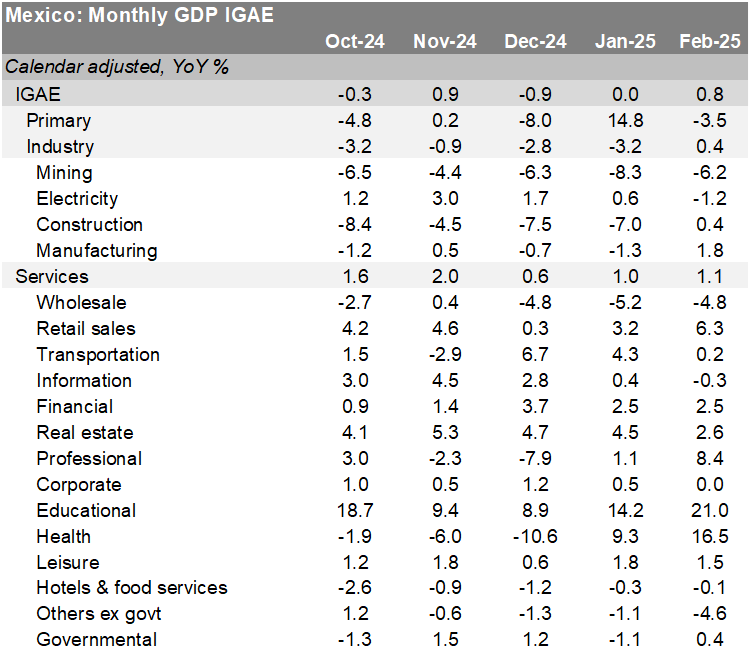

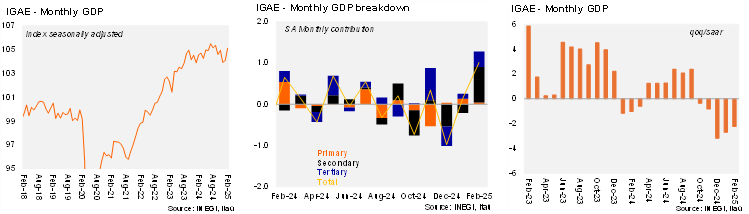

Economic activity decreased by 0.72% YoY in February, which was lower than both Bloomberg’s market consensus and our forecast (-1.1% and -1.7%, respectively). This figure was affected by seasonal distortions due one fewer day in February 2025 (a leap year in 2024). After adjusting for the calendar, the economy increased by 0.8%, driven by the positive performance of the services sector (+1.1%, with 9 out of 14 subsectors showing growth) and the industrial sector (+0.4%, with a rebound in manufacturing and construction). This growth occurred despite a contraction in agriculture (-3.5%, following a significant expansion in the previous month).

When considering seasonally adjusted figures, the economy rose by 1.0% MoM (IGAE nowcast at +1.1% MoM). In terms of sectors, industrial production increased by 2.5% MoM due to growth in construction, manufacturing, and mining. Services increased by 0.6%, with positive performances in the retail sales, professional services, and leisure subsectors. Primary activities increased by 1.0% MoM, down from 3.2% in January.

Our view: Today, historical data was revised upward, with January showing a better performance. Based on the data released today and the better-than-expected figures at the end of the quarter, such as retail sales, we are forecasting a growth of 0.2% QoQ SA in the first quarter, indicating that Mexico avoided a technical recession for now. Given all uncertainties, we maintain our GDP forecast of a 0.5% contraction for 2025.

See details below