2025/11/07 | Julia Passabom & Mariana Ramirez

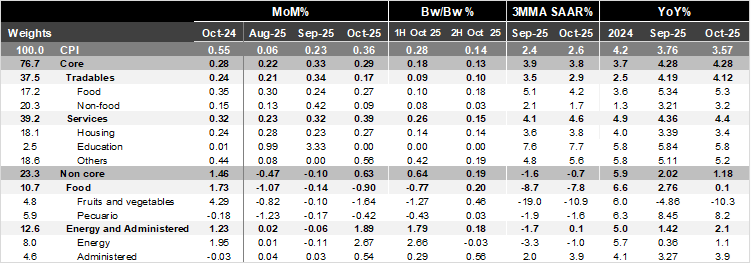

Bi-weekly headline CPI for the second half of October was 0.14%, between Bloomberg’s market consensus and our forecast (0.12% and 0.17%, respectively). Core inflation came in at 0.13%, also between market's expectations of 0.11% and our forecast of 0.12%. Within the core component, tradable prices rose by 0.10% 2w/2w, slightly up from the previous fortnight's 0.09% due to inflation in food merchandise. Services prices increased by 0.15% 2w/2w, down from the previous data of 0.26%, driven by housing and other services (air transportation, touristic services, restaurants, and professional services). The non-core component increased by 0.19% 2w/2w due to rises in agricultural prices, including both fruits and vegetables (0.46%) and livestock (0.03%). Tariffs increased by 0.56% affected by the latest increases in public transportation fees.

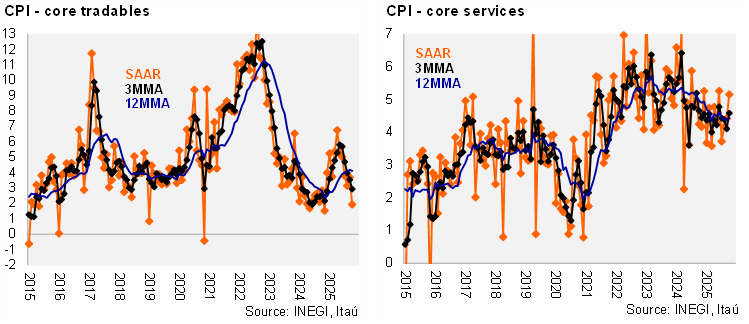

In annual terms, headline inflation was at 3.57% in October, remaining below the 4% threshold since the second half of April. Core CPI was relatively stable at 4.28%, with tradables at 4.12% (down from 4.19%) and services at 4.44% (slightly up from 4.36%). Core measures continued to show relief at the margin: core CPI is at 3.8% 3MMA SAAR, with tradables at 2.9% and services at 4.6%. Within services, pressure continued in other service categories (5.6%) and education (7.7%), the latter affected by different dates in the school calendar in 2025.

Our take: Today’s report continues to show improvements in core inflation dynamics in October, especially in tradables. We forecast the CPI to end 2025 at 4.1%, with a downside bias, and 2026 at 3.7%. Regarding monetary policy, we anticipate an additional 25-bp cut in December, leading to a year-end monetary policy rate of 7.0% in 2025. For 2026, we expect Banxico to be more dependent on CPI and FOMC dynamics. Currently, our scenario includes two more 25-bp cuts at the first two meetings next year, with the terminal rate reaching 6.5%. However, given the shift in guidance in yesterday’s statement and uncertainty surrounding the Fed’s trajectory, we think a pause in early 2026 is possible.

See details below