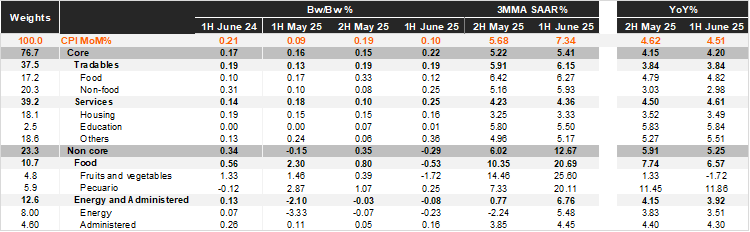

Bi-weekly headline CPI for the first half of June was 0.10%, slightly below Bloomberg’s market consensus of 0.11% and lower than our forecast of 0.15%. Core inflation came in at 0.22%, above both market’s expectations and our forecast of 0.18% and 0.19%, respectively. Within the core component, tradable prices rose by 0.19% 2w/2w, the same as in the previous fortnight. Services prices increased by 0.25% 2w/2w, up from the previous data of 0.10%, due to the housing and other services category, particularly air transport and restaurants. The non-core component decreased by 0.29% 2w/2w due to a decline in fruit and vegetable prices, which fell by 0.53% during the fortnight in items such as tomatoes, papayas, zucchinis, and bananas.

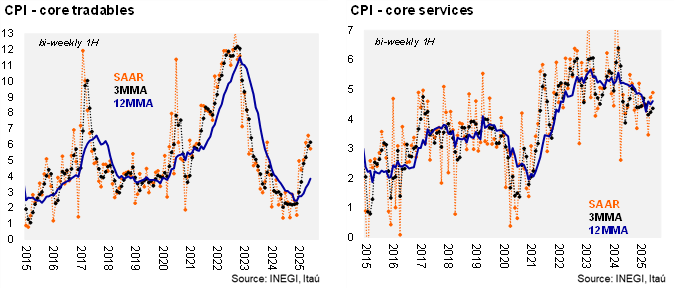

In annual terms, headline inflation decelerated to 4.51% from 4.62% in the second half of May but remains above the 4% threshold. Core CPI increased, rising from 4.15% in the previous fortnight to 4.20% now, with tradables at 3.84% (unchanged) and services at 4.61% (up from 4.50%). In the May 15 monetary policy statement, Banxico forecasted 3.9% for both headline and core inflation during 2Q25, well below today’s data. Core measures remain under pressure at the margin: core CPI is at 5.41% 3MMA SAAR (tradables at 6.15% and services at 4.36%).

Our take: Today’s report reinforces our view that the disinflation process has already occurred, with headline inflation projected to oscillate around the ceiling of Banxico’s inflation target tolerance range, down from nearly 9% at its peak in 2022. Most of the disinflation resulted from non-core items, while core goods inflation continues to accelerate at the margin, and core services remain sticky in the context of a still-tight labor market. We forecast CPI to end 2025 at 3.9%. Regarding the policy rate, we maintain our call for a 50-bps rate cut at the June 26 meeting, bringing it down to 8.0%. However, given recent inflation dynamics and lower interest rate differentials with the US, we believe Banxico will opt for a more cautious forward guidance, opening the door to slower rate cuts ahead.

See details below