2025/11/11 | Julia Passabom & Mariana Ramirez

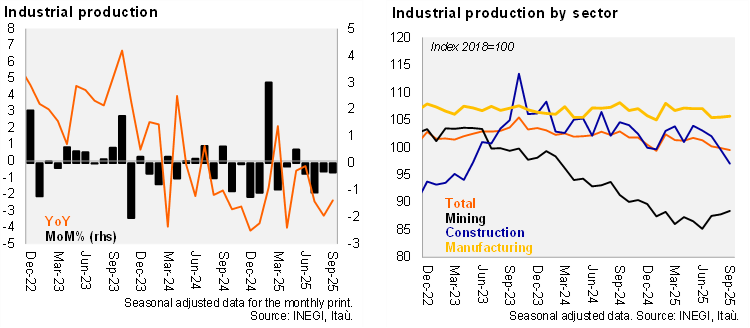

Industrial production (IP) decreased by 2.4% YoY in September, aligning with both Bloomberg’s market consensus and our forecast. The annual figures showed a broad-based contraction, with mining at -3.1%, utilities at -0.1%, construction at -7.9%, and manufacturing at -0.8%. Using seasonally adjusted figures, IP decreased by 0.4% MoM, performing worse than the consensus, which expected no change, our forecast of -0.1%, and INEGI’s nowcast of +0.1%. This performance was driven by a contraction in construction (-2.5%, with declines in buildings and civil engineering). Growth in the other sectors couldn’t offset this contraction: mining increased by 0.7% MoM, due to metal mining, manufacturing rose by 0.2%, as four out of 21 subsectors increased, and utilities grew by 0.4%, following a notable monthly growth in August of 1.1%.

Our take: Today's release showed a challenging third quarter, with the QoQ/SAAR at -6.1% due to declines in manufacturing (-5.8%), construction (-12.1%), despite positive performance in utilities (+2.8%) and mining (+7.3%). Looking ahead, we expect Mexico’s growth to continue receiving some support from external factors, though these will become less significant compared to the beginning of 2025. The outlook for domestically driven sectors will remain mixed, with a slowdown in local services and a contraction in investment. However, investment could continue to show signs of improvement due to the start of public projects, such as railways construction and road maintenance. We also anticipate a positive, albeit small, impact from the 2026 World Cup on both consumption and investment. We forecast 0.6% GDP growth in 2025 and 1.5% in 2026. In 2026, the first trilateral review meeting of the USMCA will be held no later than July 1, which could potentially create more uncertainty.

See more details below: