2025/12/03 | Julia Passabom, Mariana Ramirez & Ignacio Martínez

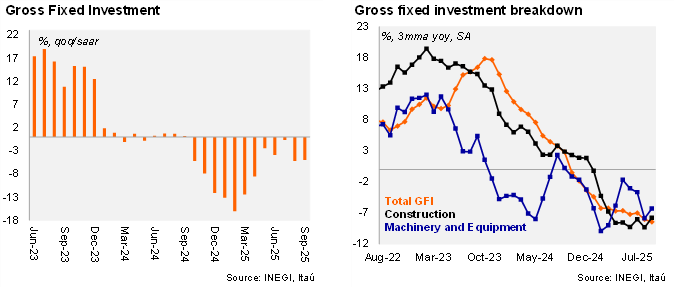

Gross Fixed Investment (GFI) fell by 6.7% YoY in September, a smaller contraction than Bloomberg’s consensus of -7.7%. By sector, machinery and equipment decreased by 2.4% YoY, with mixed results: a decline of 7.7% for domestic components and an increase of 1.3% for imported ones. Construction plunged by 10.6% YoY, with all segments in negative territory, including both residential and non- residential, as well as both private and public sectors. Using seasonally adjusted data, investment fell by 0.3% MoM, better than market expectations of -0.8% (last month data was updated to -3.0% MoM, from -2.7%). Machinery and equipment increased by 1.9%, while construction declined by 2.6% due to declines in both residential and non-residential groups.

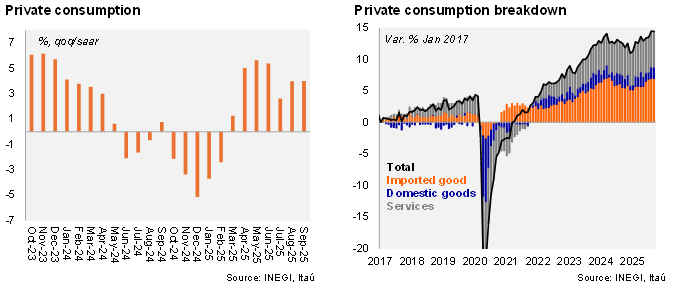

Private consumption increased by 3.6% YoY, exceeding market consensus of -1.6%. August data was also revised up to +0.6% MoM, from +0.1%. By sector, the highlight was imported goods, which rose by 14.8% YoY, while domestic goods consumption also increased compared to September 2024, albeit to a lesser extent (+1.6%). On a monthly basis, using seasonally adjusted data, private consumption was stable in September. Private consumption dynamics are supported by solid growth in the real wage bill (7.1% YoY in October).

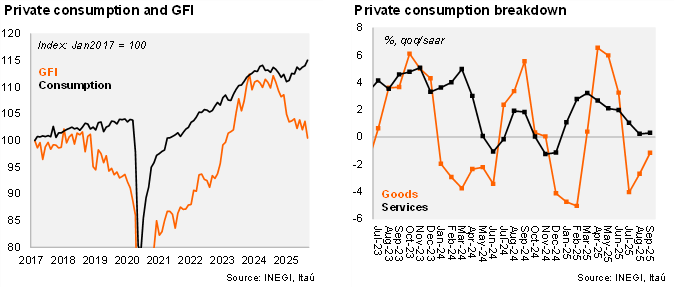

Our view: Domestic demand data by the end of 3Q25 still reflects the differing dynamics between private consumption (more positive) and investment (full year of sequential monthly contractions). Both public and private investment remain weak, reflecting a slowdown in public infrastructure programs and heightened domestic policy uncertainty, particularly regarding the USMCA trade agreement. Some improvement could emerge with the launch of public projects such as railway construction and road maintenance. However, the stagnant trend in capital goods imports signals limited support for private investment in the near term. We forecast 2025 GDP growth at 0.6% YoY, with a downward bias driven by supply-side shocks and recent historical data revisions.

See details below