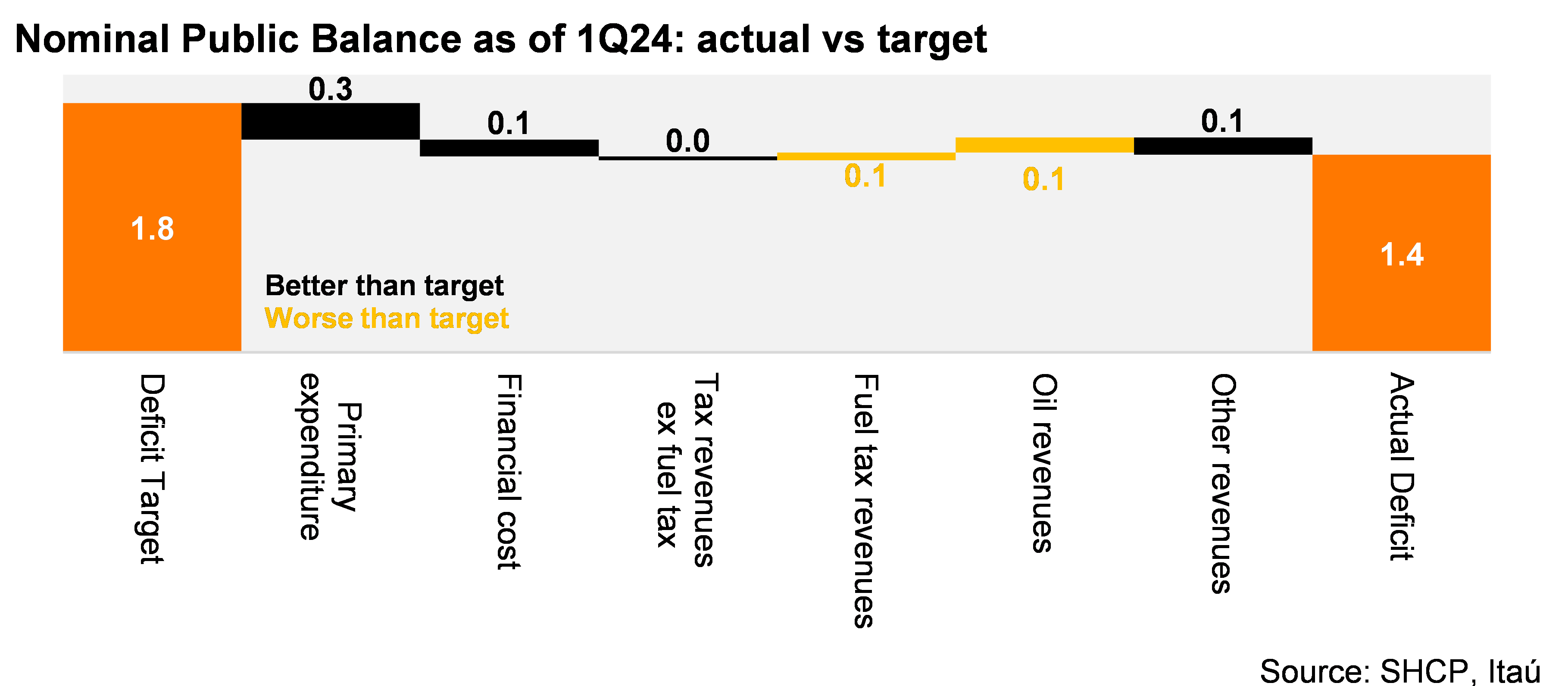

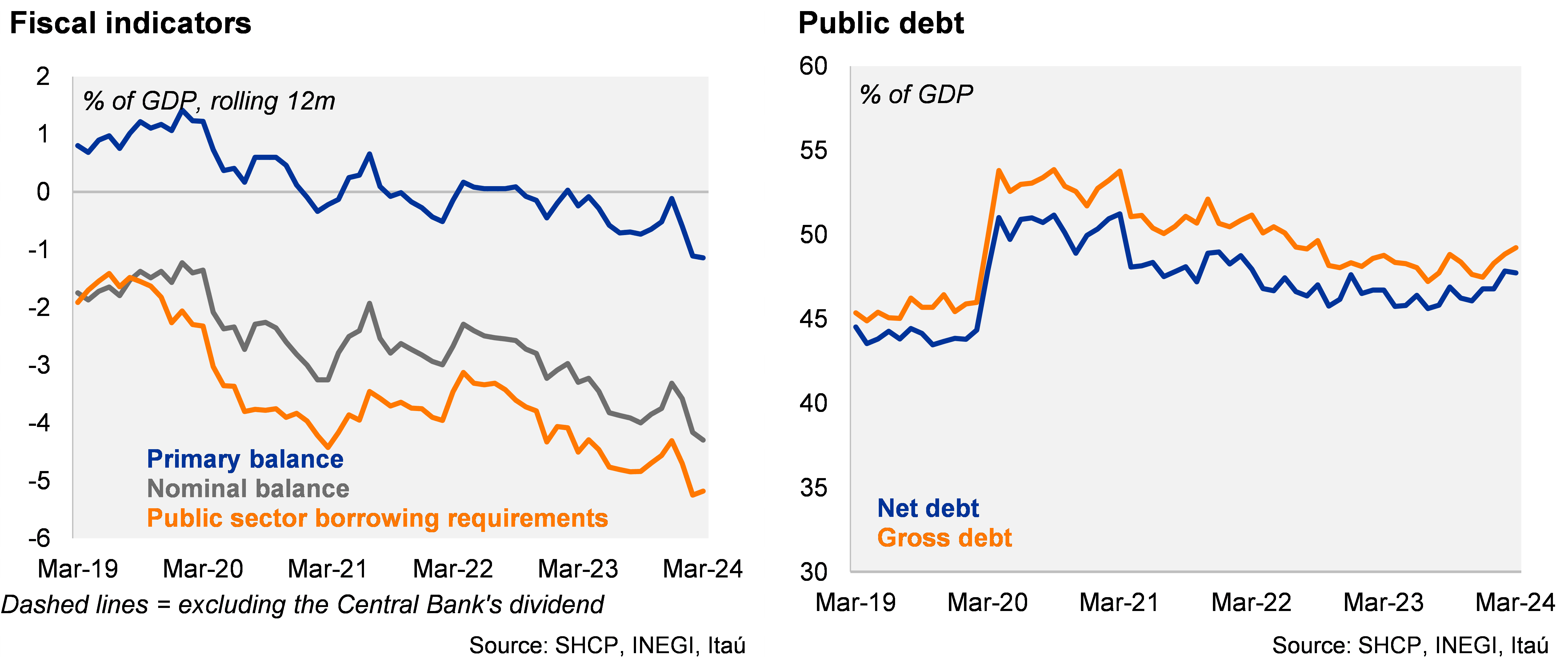

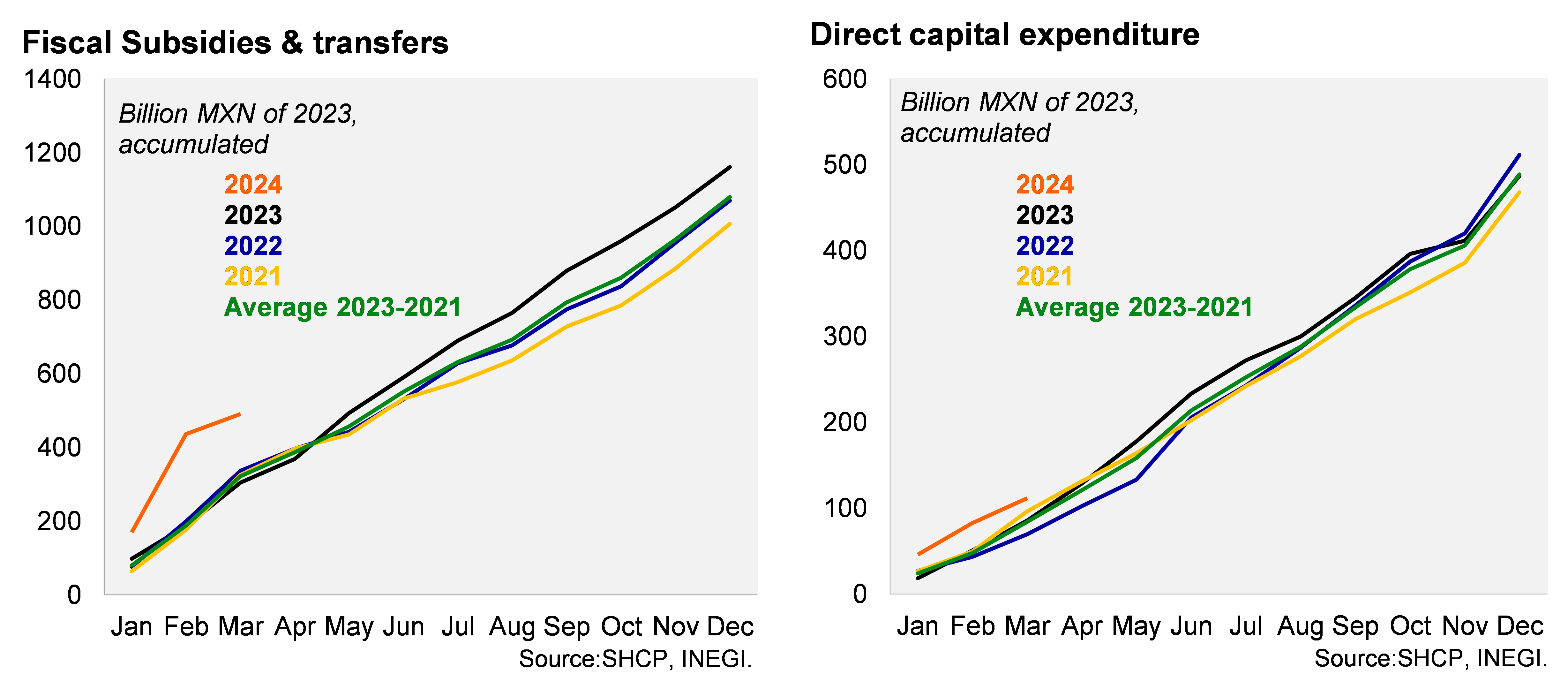

The nominal fiscal balance stood at a deficit of 1.4% of GDP as of 1Q24, compared to the MoF's 1.8% of GDP deficit target (also as of 1Q24). On a 12-month rolling basis, the nominal fiscal deficit widened to 4.3% of GDP in March, up from a deficit of 3.3% of GDP in 2023. The lower-than-programmed nominal fiscal deficit, as of 1Q24, was driven mainly by lower-than-expected primary expenditure and financial cost, which more than offset the lower than estimated oil and gasoline excise tax revenues (see chart below for further details). Weaker oil revenues are explained by lower oil production and a strong USDMXN despite higher oil prices. We note that despite lower than forecasted primary expenditure, growth in real terms was very strong (22.4% YoY as of 1Q24, in real terms). In particular, we note strong spending in subsidies & transfers (64.0% YoY as of 1Q24, in real terms), associated to social programs, and direct capital expenditure (30.2%), related to the culmination of large infrastructure projects of the current administration. Net public debt stood at 45.5% of GDP in 1Q24, compared to 46.8% end of 2023.

Our take: Fiscal results as of March are consistent with the expansionary fiscal stance concentrated mainly in 1H24, which has been one of the drivers of activity at the beginning of the year. We expect strong spending dynamics to fade during the rest of the year, more clearly during the 2H24. Our nominal fiscal deficit forecast for 2024 stands at 5.0% of GDP. Next year we expect a fiscal consolidation (nominal fiscal deficit of 2.5%) which seems challenging considering the inertia of social programs of the current administration.

See detailed data below

Julio Ruiz