2025/10/22 | Julia Passabom & Mariana Ramirez

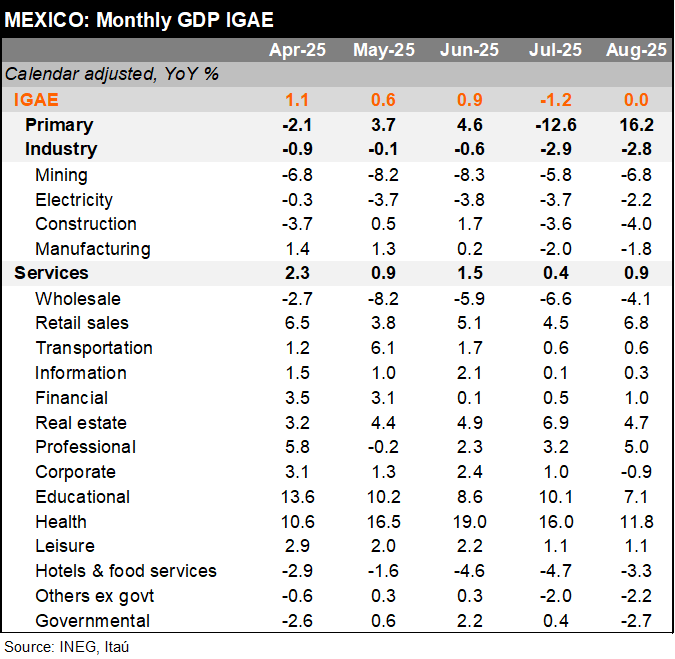

Economic activity fell by 0.9% YoY in August, which was between Bloomberg’s market consensus of -0.5% and our forecast of -1.9%. After adjusting for calendar effects, activity remained unchanged. This was due to the negative performance of industry (-2.8%, marking six consecutive annual decreases with a broad-based decline across subsectors during the month), and growth in services (+0.9%, with nine out of 14 subsectors showing growth) and agriculture (+16.2%, following a 12.6% contraction in July).

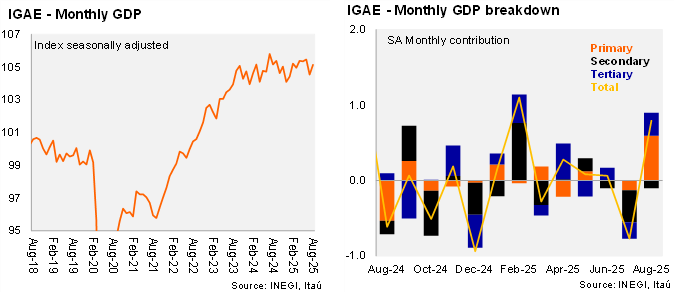

When considering seasonally adjusted figures, the economy increased by 0.6%, surpassing the IGAE nowcast of +0.1% MoM and the consensus of +0.2%. By sector, industrial production declined by 0.3% MoM due to downturns in construction and mining. Primary activities increased by 14.5% MoM, marking the highest growth since July 2024. Services increased by 0.5%, with positive performances in eight out of 14 subsectors, including retail sales, transportation, leisure, and hotels and restaurants. If primary activities had remained unchanged, economic activity would have increased by 0.2%, indicating that most of the contribution came from that sector.

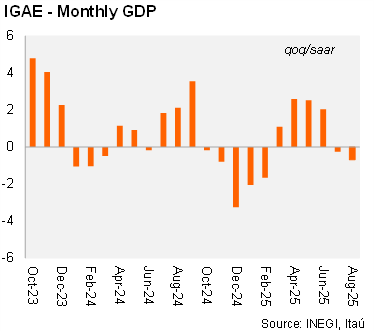

Our view: Today’s figures indicate that the economy experienced a negative performance in the third quarter, with the QoQ/SAAR at -0.7% due to declines in industry and agriculture sectors. The carry-over for 2025 is 0.3%. Since this behavior was expected, we maintain our forecast of 0.6% GDP growth in 2025, although we remain cautious about potential unexpected shocks in the fourth quarter caused by hurricanes that affected the southern and central parts of the country in October. Currently, the damage assessment is still underway.

See details below