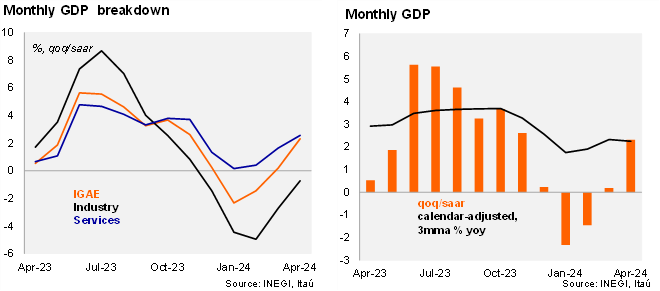

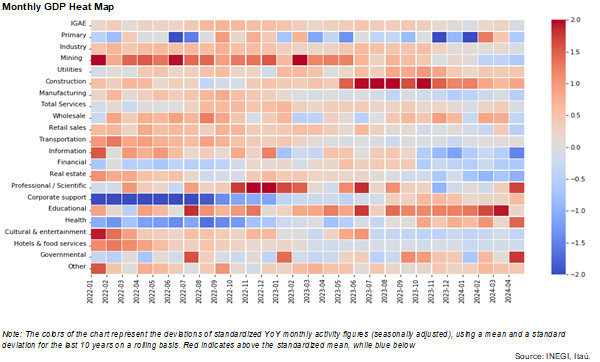

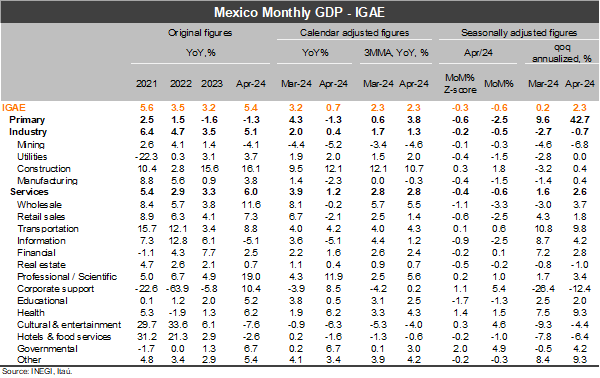

The monthly GDP (IGAE) rose by 5.4% yoy in April, above market consensus of 3.5% (as per Bloomberg), but closer to our 5.6% forecast. The annual growth figure was mainly boosted by a favorable calendar base effect (Easter Holidays) which could explain the discrepancy between the upside surprise (some analysts failing to incorporate the calendar effect in their estimates) and the downside surprise with seasonally adjusted figures (-0.6% MoM/SA vs consensus of -0.25%). The weak monthly GDP print was dragged by all subindexes: primary (-2.5%), industrial production (-0.5%) and services sector (-0.6%). Within industrial production, manufacturing output fell by 1.5%, likely dragged by the strong currency at the time. Still, activity momentum remained positive, with the qoq/saar of the monthly GDP at 2.3% in April (from 0.2% in 1Q24)

Our take: We expect activity to weaken more clearly in the 2H24 given softer fiscal expenditures after elections and amid the transition between administrations. The recent depreciation of the currency, associated to political uncertainty, is likely to mitigate the slowdown in activity, boosting remittances in MXN, a relevant determinant for private consumption, and manufacturing output. We note the latter has been relatively muted given the overly strong currency despite the resilient external demand. Our GDP growth forecast for 2024 of 2.3% has a downward bias.

See detailed data below