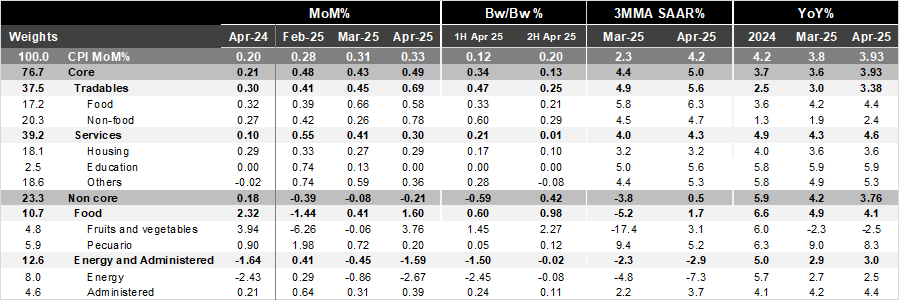

Bi-weekly headline CPI for the second half of April was 0.20%, higher than Bloomberg’s market consensus (0.14%) and our forecast (0.03%). Core inflation came in at 0.13%, a tad above expectations (market at 0.11% and our forecast at 0.09%). Within the core component, tradable prices rose by 0.25% 2w/2w, down from 0.47% in the previous fortnight. Services prices rose 0.01% 2w/2w, lower than the previous data (0.21%), due to deflation in some services such as transportation and leisure. The non-core component increased by 0.42% 2w/2w due to pressures in agricultural prices for items such tomatoes and avocados. Energy prices decreased during the fortnight (-0.08%), following a notable contraction in the previous reading (-2.45%).

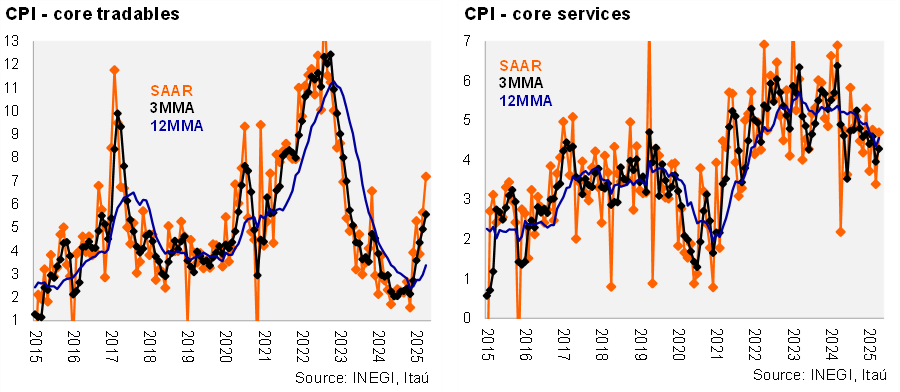

In annual terms, headline inflation accelerated to 3.93%, from 3.80% in March. Core CPI also increased, rising from 3.60% in the previous month to 3.93% now, with goods at 3.38% (up from 3.0%) and services at 4.56% (up from 4.3%). In the March 27 statement, Banxico forecasted 3.5% for both headline and core inflation during 2Q25, well below today’s data. Core measures remain under preassure at the margin: core CPI 5.0% 3MMA SAAR (tradables 5.6% and services 4.3%).

Our take: Today’s report reinforces our view that the disinflation process has already occurred, and headline inflation is projected to oscillate close to the ceiling of Banxico’s inflation target tolerance range, down from nearly 9% at its peak in 2022. Most of the disinflation came from non-core items, while core goods inflation continues to accelerate at the margin, and core services remain sticky in a still tight labor market scenario. We forecast the CPI to end 2025 at 3.9%. Regarding the policy rate, we maintain our call for a 50-bps rate cut next week, down to 8.5%.