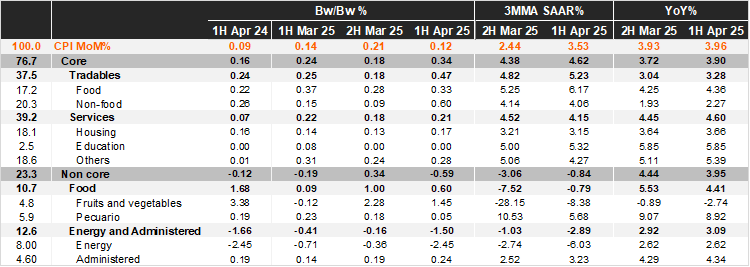

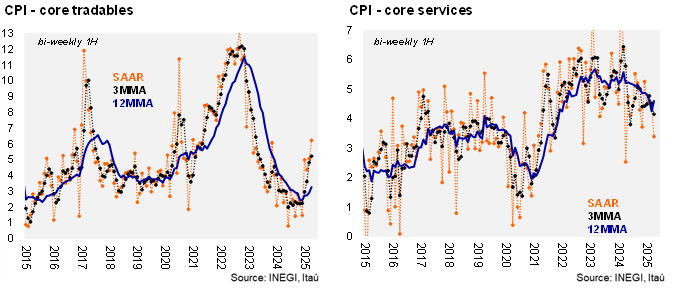

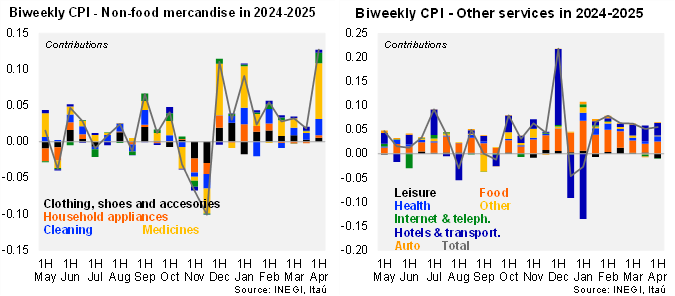

Bi-weekly headline CPI for the first half of April was 0.12%, above Bloomberg’s market consensus of 0.03% and our forecast of -0.11%. Core inflation came in at 0.34%, higher than expectations (market at 0.24% and our forecast at 0.17%). Within the core component, tradable prices were up 0.47% 2w/2w, from 0.18% in the previous fortnight, with pressures from items such as automobiles and personal care. Service prices rose by 0.21% 2w/2w, slightly higher than the previous data at 0.18%, driven by other services, with some pressure from tourism-related items ahead of the Easter holidays. The non-core component decreased by 0.59% 2w/2w due to deflation in energy prices during the fortnight (-2.45%). Despite the start of electricity subsidies applied during the hot weather in northern states, tariff component increased by 0.24% 2w/2w.

In annual terms, headline inflation slightly accelerated to 3.96%, from 3.93% in the second half of March. Core CPI also increased, rising from 3.72% in the previous month to 3.90% now, with merchandise at 3.28% (up from 3.04%) and services at 4.60% (up from 4.45%). In the March 27 statement, Banxico forecasted 3.5% for both headline and core inflation during 2Q25, below data published today.

Our take: Today’s report showed that seasonal patterns affected inflation more than expected and reinforces our view that tradable goods will return to their pre-pandemic trend and pressure core inflation in the coming months. Additionally, the inflation outlook remains challenging, with somewhat sticky service inflation and volatile climate conditions, including droughts in certain parts of the country, posing risks. We forecast the CPI to end 2025 at 3.9%. Regarding the policy rate, considering the weak economic activity and forward guidance, we maintain our call for a 50-bps rate cut on May 15, bringing it down to 8.5%.