2026/01/22 | Julia Passabom, Mariana Ramirez & Ignacio Martínez

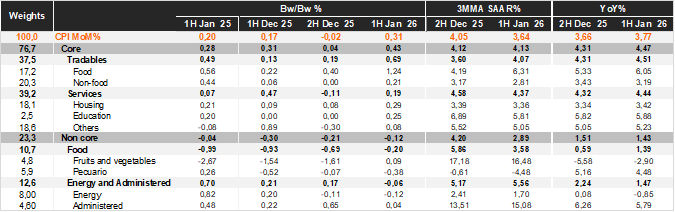

According to INEGI, first-half CPI for January posted a 2w/2w increase of 0.31%, below Bloomberg’s market consensus of 0.4%, but closer to our call of 0.35%. Similarly, Core CPI registered a 0.43% advance, also underperforming market expectations (0.46%) and somewhat closer to our estimate (0.4%). Within the core component, tradables rose 0.69% 2w/2w, with the food subcomponent showing a significant increase (+1.24%). Meanwhile, goods excluding food came at 0.21%, showing no effects yet of the recent tariffs increase on Chinese goods implemented this month. On the services side, prices advanced 0.19% 2w/2w, with Housing and Education categories posting the highest increases (0.29% and 0.25% respectively). In contrast, the non-core CPI recorded a 0.12% contraction, driven mainly by food prices (-0.20%).

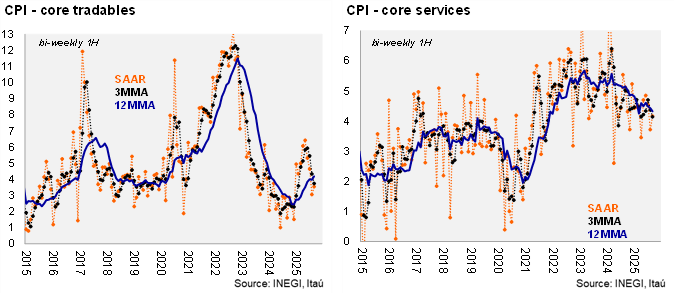

In annual terms, today’s results show broad-based increases across components. Headline inflation stood at 3.77% in the first half of January, remaining below the 4% threshold but increasing from 3.66% in 2H December. Core CPI also rose in annual terms, from 4.31% to 4.47%, with tradables at 4.51% (up from 4.31%) and services at 4.44% (up from 4.32%). At the margin, core measures were relatively stable: core CPI reached 4.13% on a 3MMA SAAR basis (4.12% in 2H Dec25), with tradables at 4.07% and services at 4.37%. Within services, pressures remain concentrated in education (5.81%).

Our take: Despite today’s downside surprise in the data, the increase in annual inflation—both in headline and core terms—remains a source of concern for the pace of disinflation. Moreover, we still do not observe clear signs of disinflation at the margin. Taken together, we do not view this downside surprise as a game changer for Banxico. We continue to expect that at the February 5 meeting the Central Bank will keep the policy rate at 7%, followed by one final 25bp cut in May.