2025/09/09 | Julia Passabom & Mariana Ramirez

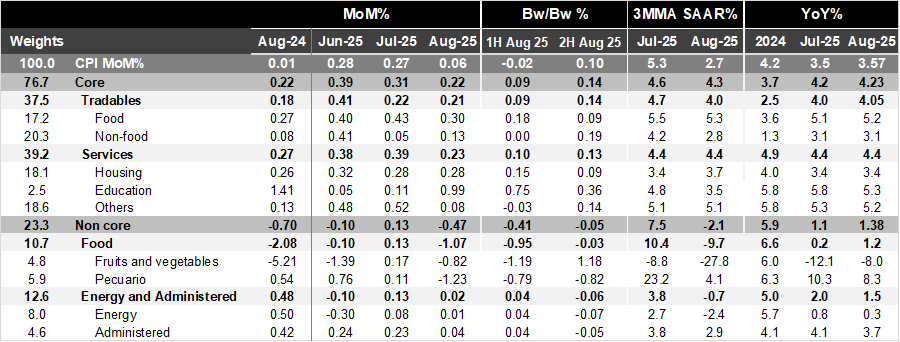

Bi-weekly headline CPI for the second half of August rose by 0.10%, slightly above Bloomberg’s market consensus of 0.07% and below our forecast at 0.16%. Core inflation came in at 0.14%, also below the market's expectations at 0.10% but closer to our forecast of 0.13%. Within the core component, tradable prices rose by 0.14% 2w/2w, slightly up from the previous fortnight's 0.09%, due to non-food merchandise prices. Services prices increased by 0.13% 2w/2w, up from the previous data of 0.10% driven by education due to the back-to-school season (0.36%). The non-core component decreased by 0.05% 2w/2w due to deflation in the agricultural and energy component, which fell by 0.03% and 0.06% during the fortnight, respectively.

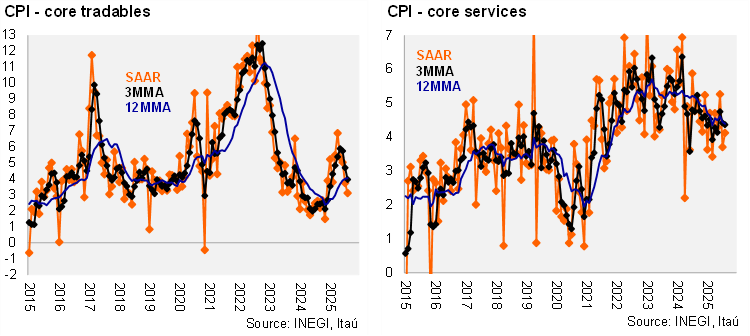

In annual terms, headline inflation rose to 3.57% in August, remaining below the 4% threshold since the second half of April. Core CPI was relatively stable, moving slightly to 4.23% now, with tradables at 4.05% (up from 4.02%) and services at 4.40% (down from 4.44%). We observed a significant marginal relief in core inflation: core CPI is at 4.3% 3MMA SAAR, with tradables at 4.0% and services at 4.4%. Within services, the pressure did not ease in other service categories.

Our take: Today’s report kept showing improvements in core inflation dynamics, which remains above 4% year-over-year, but is now considerably better at the margin. We forecast CPI to end 2025 at 4.1% and 3.7% in 2026. Regarding monetary policy, our current scenario considers another 25-bp cut in September, with all options on the table beyond that, including pausing or additional cuts. Our global scenario currently considers only one 25-bp cut by the Fed in December, which we believe aligns with our 7.5% endpoint. However, following the latest US payroll figures, we recognize a bias for more policy rate cuts, both in the US and Mexico.

See details below