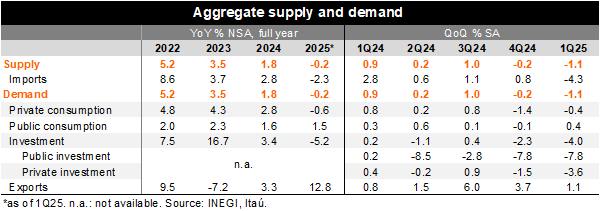

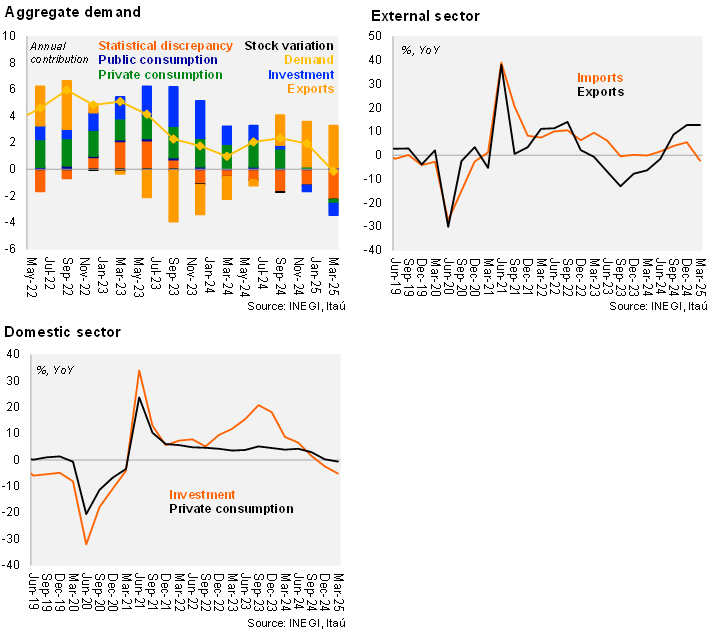

In 1Q25, aggregate supply and demand decreased by 0.2% YoY NSA (1.9% in 4Q24). Exports continued to be the main positive contributor to demand, increasing by 12.8% YoY amid tariff threats, with some signs of front-loading. Private consumption contracted by 0.6% YoY during the quarter, down from +0.3% YoY in the previous quarter, while investment declined by 5.2% YoY compared to -2.4% in 4Q24 and +1.6% in 3Q24. In seasonally adjusted terms, aggregate demand declined by 1.1% QoQ, following a contraction of 0.2% in the previous quarter. Exports were the most dynamic component, rising by 1.1% from the previous quarter, while investment contracted at its fastest pace since 2020. On the other hand, imports decreased by 4.3% due to declines in consumption and capital items.

Our take: Today’s results confirm our view that the economy is slowing, driven by domestic factors leading to a broad-based decline in domestic demand. Looking ahead, we anticipate that domestic demand will continue to be a drag, particularly in terms of investment, while consumption may remain moderate due to still-positive fundamentals. Exports are expected to be affected by the uncertainty surrounding Mexico’s trade relationship with the US. However, some indicators are showing resilience in 2Q25, including industrial production and Antad retail sales, which allows us to have a somewhat more positive outlook for growth this year. Our forecast for this year is a modest 0.2% GDP growth.

See detailed data below