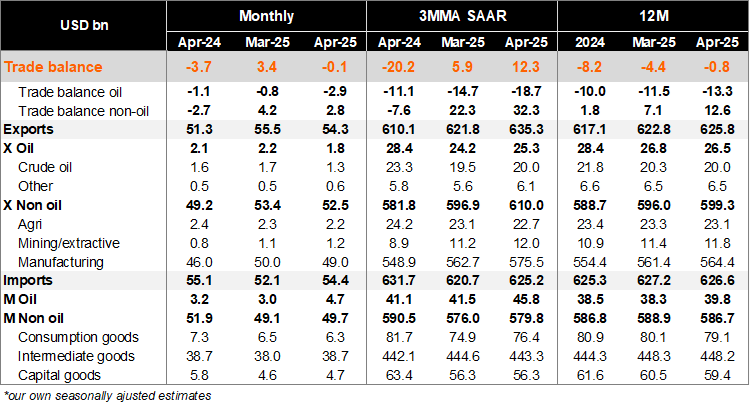

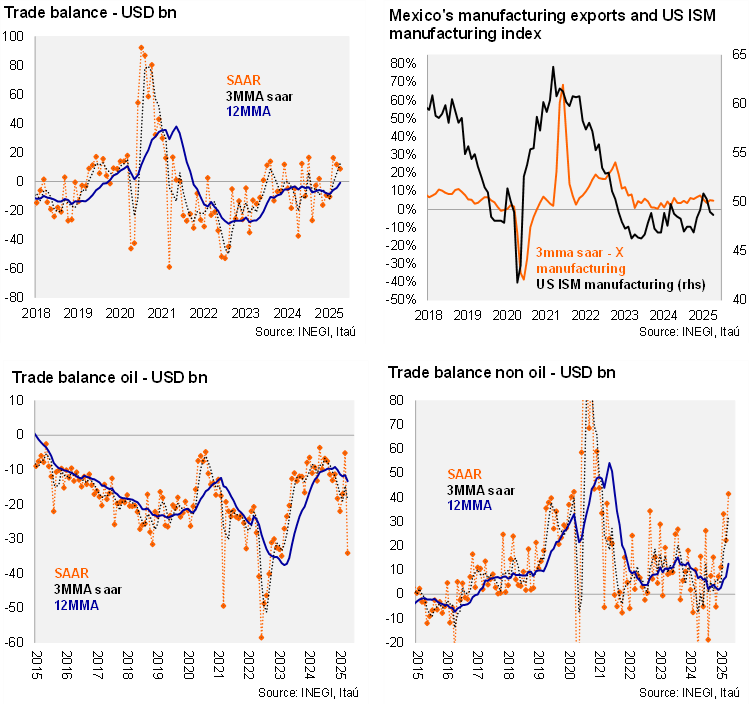

April’s trade balance revealed a USD 88 million deficit, below Bloomberg’s market consensus of a USD 115.5 mm deficit. As a result, on a 12-month rolling basis, the trade deficit reached USD 0.8 bn, up from USD 4.4 bn in March (USD 8.2 bn deficit in 2024). At the margin, using three-month annualized seasonally adjusted figures, the trade balance improved to a surplus of USD 12.3 bn (from a USD 5.9 bn surplus). Looking at the breakdown, on a 12-month rolling basis, the oil trade balance deficit continued to run negative (USD 13.3 bn deficit vs USD 12.6 bn surplus for non-oil) following the decline in domestic oil production and the government’s strategy to prioritize domestic oil refineries.

Our view: The April trade balance demonstrates the strength of external accounts amid tariff threats, with some signs of front-loading on exports. The uncertainty surrounding Mexico’s trade relationship with the US will continue to challenge trade flows. Looking ahead, the performance of oil exports will be influenced by domestic policies related to national sovereignty and the expected low oil prices. Weaker internal demand and a slowdown in construction are likely to limit non-energy consumption and capital imports, particularly for non-residential projects.

See detailed data below