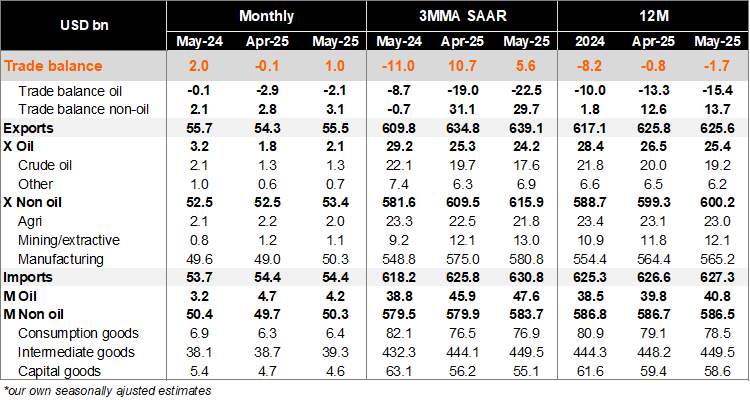

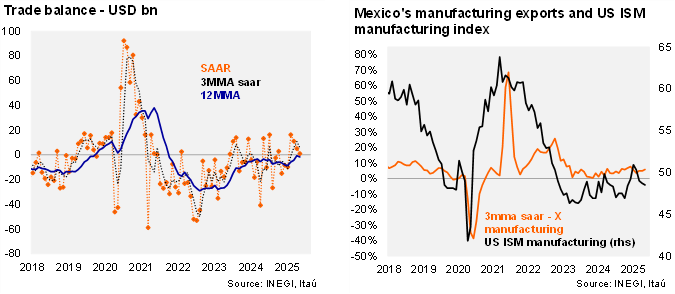

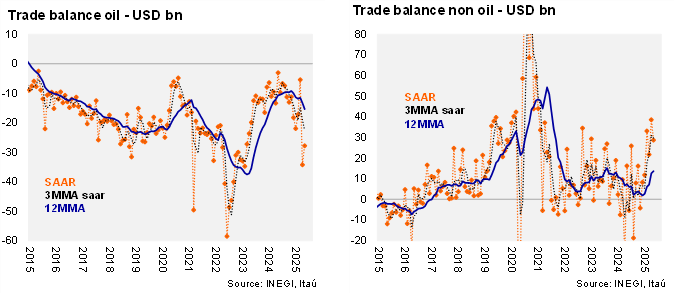

May’s trade balance revealed a USD 1.03 billion surplus, above Bloomberg’s market consensus of a USD 365 mm surplus but below the result from May 24 (USD 2 bn surplus). On a 12-month rolling basis, the trade deficit reached USD 1.7 bn, down from USD 0.8 bn in April (USD 8.2 bn deficit in 2024). At the margin, using three-month annualized seasonally adjusted figures, the trade balance oscillated to a surplus of USD 5.6 bn (from a USD 10.7 bn surplus in April). Looking at the breakdown, on a 12-month rolling basis, the oil trade balance deficit continued to run negative (USD 15.4 bn deficit vs USD 13.7 bn surplus for non-oil) following the decline in domestic oil production and the government’s strategy to prioritize domestic oil refineries.

Our view: The May trade balance demonstrates the strength of external accounts amid tariff-related uncertainty, still with some signs of front-loading on exports. The uncertainty surrounding Mexico’s trade relationship with the US will continue to challenge trade flows until a definitive USMCA renegotiation begins. Looking ahead, oil exports will be influenced by domestic policies related to national sovereignty and oil price dynamics. Weaker internal demand and a slowdown in construction are likely to limit non-energy consumption and capital imports, particularly for non-residential projects.

See detailed data below