2025/08/22 | Julia Passabom & Mariana Ramirez

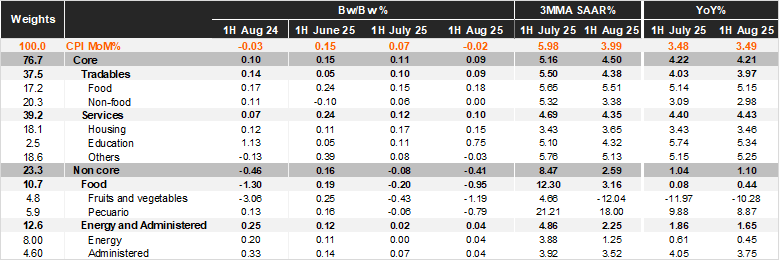

Bi-weekly headline CPI for the first half of August was negative at 0.02%, below both Bloomberg’s market consensus and our forecast, which were at 0.12%%. Core inflation came in at 0.09%, also below the market's expectations and our forecast, both at 0.14%. Within the core component, tradable prices rose by 0.09% 2w/2w, slightly down from the previous fortnight's 0.11% due to inflation in non-food merchandise. Services prices increased by 0.10% 2w/2w, down from the previous data of 0.12% due to less pressure in other services (-0.03%). The non-core component decreased by 0.41% 2w/2w due to deflation in agricultural prices, which fell by 0.95% during the fortnight in items such as tomatoes, chicken, and eggs.

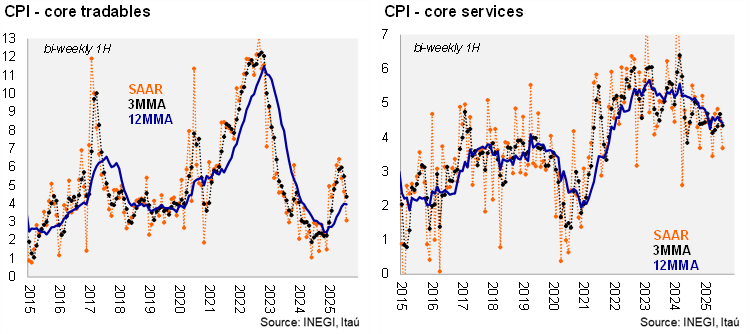

In annual terms, headline inflation was stable at 3.49% in 1H August, remaining below the 4% threshold since the second half of April. Core CPI was relatively stable as well, moving slightly to 4.21% now, with tradables at 3.97% (down from 4.03%) and services at 4.43% (up from 4.40%). Core measures remain under pressure, but we observed a significant marginal relief: core CPI is at 4.5% 3MMA SAAR, with tradables at 4.4% and services at 4.4%. Within services, the pressure eased in other service categories.

Our take: Today’s report showed an unexpected significant improvement in core inflation dynamics, which remains above 4% year-over-year, but is now considerably better at the margin. The CPI data, which came in below expectations, is good news for Banxico, with improvements in both tradables and services core inflation. We forecast CPI to end 2025 at 4.1% and 3.7% in 2026. Regarding the policy rate, our current scenario anticipates another 25-bp cut in September, with all options on the table beyond that, including pausing or continuing the easing cycle. Our global scenario considers only one 25-bp cut by the Fed in December, which we believe aligns with our 7.5% endpoint.

See details below