2025/11/21 | Julia Passabom & Mariana Ramirez

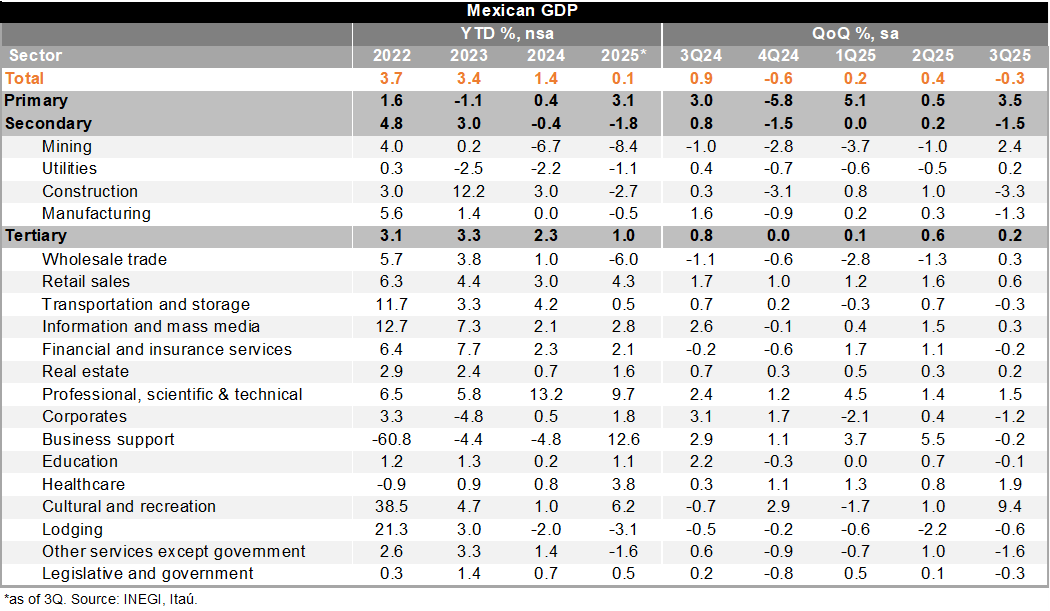

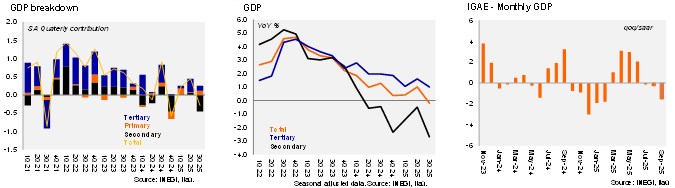

The final 3Q25 GDP fell by 0.1% YoY, a smaller contraction than expectations and the flash estimate, both of which were at -0.2%. Primary activities increased by 3.7% YoY (preliminary: +3.6%), industry decreased by 2.7% YoY (preliminary: -2.9%), and services grew by 1.1% YoY (preliminary: +1.0%). Using seasonally adjusted data, GDP fell by 0.3% QoQ, in line with the consensus forecast and slightly better than our call (-0.4%). Primary activities and services were the main drivers, at 3.5% and 0.3%, respectively, while industry decreased by 1.5%. In the first nine months of the year, the economy grew by 0.4% YoY on a seasonally adjusted basis, mainly due to the primary and tertiary sectors, despite a contraction in industry.

According to the monthly GDP (IGAE), the economy contracted by 0.6% MoM in September, a deeper contraction than both the consensus (-0.1%) and our forecast (-0.2%). On a monthly basis, a broad base contraction was observed: tertiary sector fell by 0.5%, agriculture declined by 4.9%, and industry activities decreased by 0.4%. The QoQ/SAAR was -1.0% in 3Q25, down from -0.3% in the previous quarter. Historical data was revised, showing a worse performance overall.

Our take: Today’s release suggests that activity decelerated in the third half of the year, with a statistical carry-over for 2025 at 0.4%. This behavior was already anticipated, after a very strong 2Q25. Looking ahead, we expect Mexico’s growth to continue receiving some support from external factors, though these will become less significant compared to the first quarter of 2025. The outlook for domestically driven sectors will remain mixed, with a slowdown in local services and a contraction in investment. However, investment could continue to show signs of improvement due to the start of public projects, such as railways construction and road maintenance. While we maintain our GDP forecast of an expansion of 0.6% in 2025, it is somewhat skewed to the downside.

See detailed data below