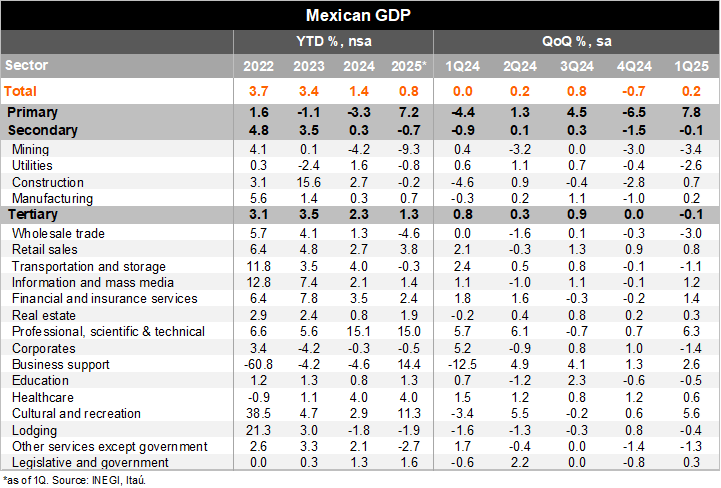

The 1Q25 final GDP rose 0.8% YoY, in line with the flash estimate and market expectations. Primary activities stood at +7.2% YoY (preliminary: +6.4%), industry at -0.7% YoY (preliminary: -0.9%) and services at +1.3% YoY (preliminary: +1.5%). Using seasonally adjusted data, GDP increased 0.2% QoQ (in line with the preliminary estimation), with industry and services activities as the main drags, both at -0.1%, while the primary sector increased 7.8%. Additionally, historical data was revised, with a tad better result for 2023 (from 3.3% to 3.4% YoY) and down for 2024 (from 1.5% to 1.4% YoY).

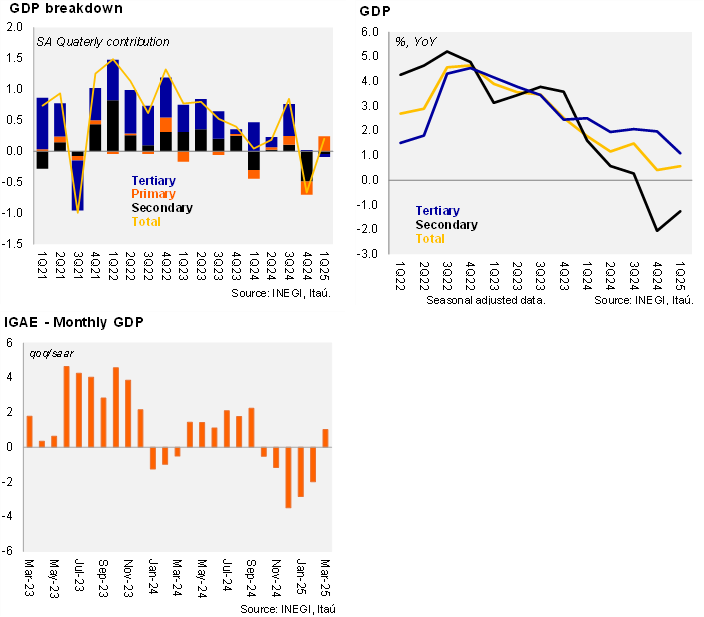

According to the monthly GDP (IGAE), the economy contracted by 0.36% MoM in March, a tad worse than both the consensus (-0.05%) and our forecast (0.00%). On a monthly basis, only the primary sector grew (+4.3%), while services and industry activities declined by -0.4% and -0.9%, respectively. The QoQ/SAAR stood at +1.0% in the 1Q25, from -2.0% in the previous quarter.

Our take: Today’s release confirmed that Mexico has avoided a technical recession for now, with a statistical carry-over for 2025 at 0.2%. However, the only source of growth came from the agricultural sector in the 1Q25. Looking ahead, we continue to anticipate weaker performance from the international sources of Mexico’s growth, primarily in manufacturing exports, although with some frontloading, and certain services such as freight and wholesale trade. The outlook for domestically related sectors is mixed, with moderation in local services and a contraction in construction and investment. The government is focused on strengthening the domestic drivers amid changes in the global outlook. Given all these uncertainties, we maintain our GDP forecast of a 0.5% contraction for 2025.

See details below