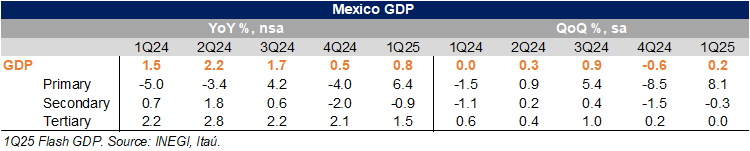

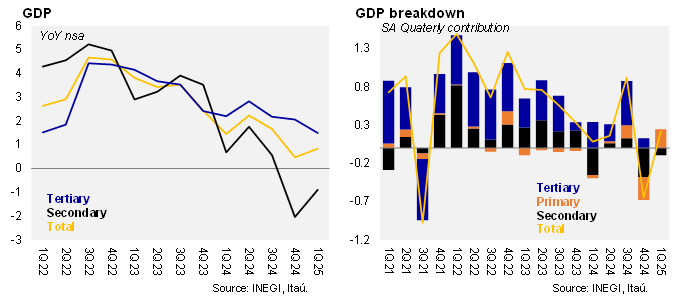

The 1Q25 flash GDP rose 0.8% YoY, in line with our forecast and close to Bloomberg’s market consensus of 0.7%. This represented a slight acceleration compared to 4Q24, which was +0.5% YoY. Primary activities increased by 6.4%, industry declined by 0.9%, and services grew by 1.5% on an annual basis. This quarter was affected by one less day in February 2025 (due to the leap year in 2024) and different Easter holiday dates compared to 2024 (2Q25 vs. 1Q24). Using seasonally adjusted figures, GDP rose 0.2% QoQ, driven by the strong performance of agriculture at 8.1%, despite no growth in services and a contraction in the industry by 0.3%.

Considering that the observed monthly GDP averaged a contraction of 0.4% YoY in January-February, today’s estimate implies that March was close to +3.3% YoY. Our calculations suggest a quiet end to the quarter with zero monthly growth (down from +1.0% in February), in line with INEGI’s nowcast. The final GDP release is scheduled for May 22. We don’t expect significant changes from today’s 1Q25 data. However, as is usual for this time of year, historical data is likely to be adjusted following the inclusion of more annual data from INEGI.

Our take: Today’s release indicates that Mexico has avoided a technical recession for now, with a statistical carry-over for 2025 at 0.2%. However, the only source of growth came from the agricultural sector. Looking ahead, we continue to anticipate weaker performance from the international sources of Mexico’s growth, primarily in manufacturing exports, although with some frontloading, and certain services such as freight and wholesale trade. The outlook for domestically related sectors is mixed, with moderation in local services and a contraction in construction and investment. The government is focused on strengthening the domestic market amid changes in the global outlook, which might be a modest driver for growth going forward. Given all these uncertainties, we maintain our GDP forecast of a 0.5% contraction for 2025. Regarding interest rates, weak activity adds to the recent Board communication favoring a 50 bps cut at the Banxico's next meeting (May 15) to 8.5%.

See detailed data below