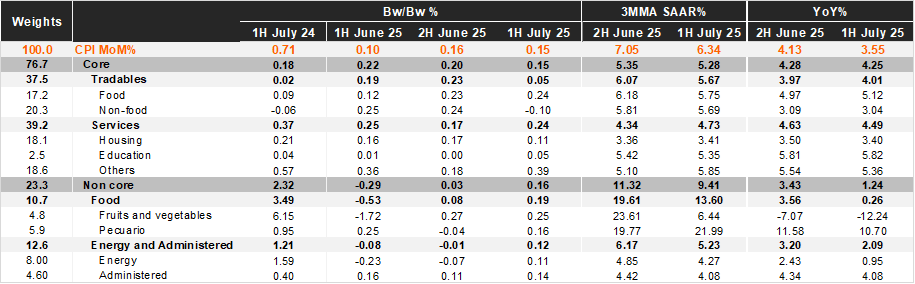

Bi-weekly headline CPI for the first half of July was 0.15%, below Bloomberg’s market consensus of 0.22% and our forecast of 0.32%. Core inflation came in at 0.15%, also below both market’s expectations of 0.21% and our forecast of 0.22%. Within the core component, tradable prices rose by 0.05% 2w/2w, down from the previous fortnight’s 0.23% due to deflation in non-food merchandise. Services prices increased by 0.24% 2w/2w, up from the previous data of 0.17%, with pressures from housing, air transportation, and restaurants. The non-core component increased by 0.16% 2w/2w due to pressure on agricultural prices, which rose by 0.19% during the fortnight in items such as eggs, onions, and lettuce.

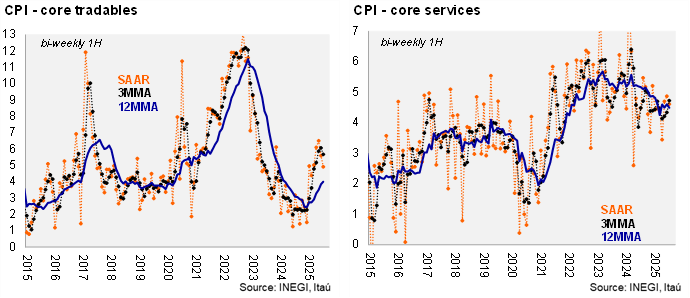

In annual terms, headline inflation decelerated to 3.55% in the first half of July from 4.13% in the previous fortnight, below the 4% threshold since the second half of April. Core CPI slightly decreased from 4.28% in the previous bi-weekly figure to 4.25% now, with tradables at 4.01% (up from 3.97%) and services at 4.49% (down from 4.63%). In the June 26 monetary policy statement, Banxico forecasted 4.3% for headline inflation and 4.1% for core inflation during 2Q25, slightly above the current headline rate at 4.06%, and below the core rate of 4.24% as of the first half of July. Core measures remain under pressure at the margin: core CPI is at 5.28% 3MMA SAAR (tradables at 5.67% and services at 4.73%). Within services, the other services and housing components were the main drivers for the acceleration at the margin.

Our take: Today’s report reinforces our view that the disinflation process has already occurred, with headline inflation projected to oscillate around the ceiling of Banxico’s inflation target tolerance range, down from nearly 9% at its peak in 2022. Goods inflation remains high at the margin, although it appears to be peaking, and the current USDMXN appreciation should support additional disinflation ahead. Services inflation is decelerating, albeit at a slower pace, which is compatible with labor market dynamics and sticker prices in this sector. We recently adjusted our forecast for CPI to end 2025 at 4.1%, given recent inflation dynamics and some past short-term upward surprises. Regarding the policy rate, we maintain our call for a 25-bps rate cut at the August 7 meeting, bringing it down to 7.75%. Banxico may cut further, conditional on inflation dynamics and the Fed. We expect only one 25-bp cut by the Fed this year, in December.

See details below