2025/12/23 | Julia Passabom, Mariana Ramirez & Ignacio Martínez

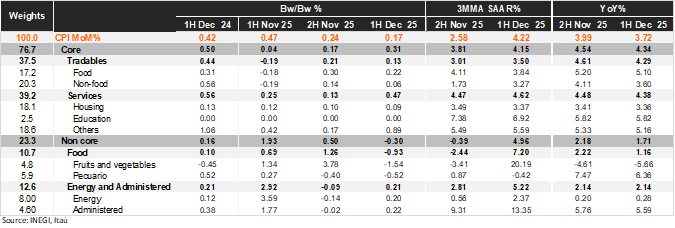

According to INEGI, first-half CPI for December posted a 2w/2w increase of 0.17%, below both Bloomberg’s market consensus (0.32%) and our estimate (0.39%). Similarly, the Core CPI registered 0.31%, also underperforming market expectations (0.41%) and our call (0.40%). Within the core component, tradables rose 0.13% 2w/2w, with the food subcomponent showing the largest increase (+0.22%). Meanwhile, goods excluding food came in slightly lower than our previous estimate (0.06% vs. 0.17%), consistent with expectations of no payback. On the services side, prices advanced 0.47% 2w/2w, with Others category posting the highest increase (0.89%). In contrast, the non-core CPI recorded a 0.3% contraction, driven mainly by food prices (-0.93%).

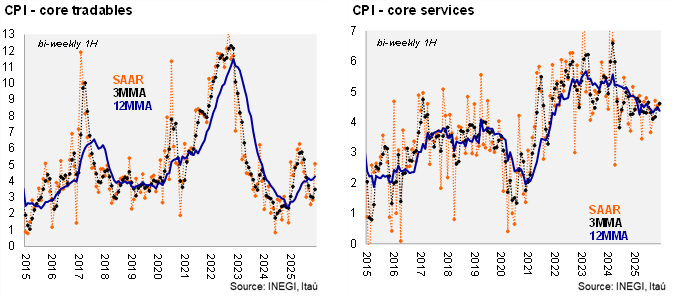

In annual terms, today’s results show broad-based declines across all components. Headline inflation stood at 3.61% in the first half of December, remaining below the 4% threshold and down from 3.99% in 2H November. Core CPI eased to 4.32%, from 4.54% previously, with tradables at 4.29% (down from 4.61%) and services at 4.38% (slightly up from 4.46%). However, core measures indicate some acceleration at the margin: core CPI reached 4.15% on a 3MMA SAAR basis (up from 3.81%), with tradables at 3.5% and services at 4.62%. Within services, pressures remain concentrated in education (6.92%).

Our Take: This downside surprise and the generalized annual decline are positive developments for Banxico, as they help ease inflationary pressures observed in previous months. However, certain risks persist at the margin, particularly within core services. We maintain our expectation that Banxico will opt for a 25bp rate cut in February, bringing the terminal rate to 6.75%.