Shifts in US economic policy – including trade, migration, and fiscal policy – should eventually spillover to the region, as has been reflected by the changes to our macro forecasts in recent months.

In this context, following the swift approval by the House of Representatives, the US Senate is discussing a broad-based tax reform that, in a nutshell, raises pressure on the fiscal accounts mainly through the implementation of tax cuts for households and firms, with nominal deficits estimates in the order of 6.0-7.0% of GDP between 2025-2029, under different scenarios. Political analysts place an increasingly greater likelihood on the approval of the US tax bill that includes this measure prior to the August recess.

Rather than focus on the overall effects of the bill of the US and the region, in this note we briefly discuss one instrument. One of the measures of the bill being discussed by the US Senate is a 3.5% federal tax on outbound remittances (below the initial proposal of 5%) from non-US citizens and nationals, with status to be verified by a third-party.

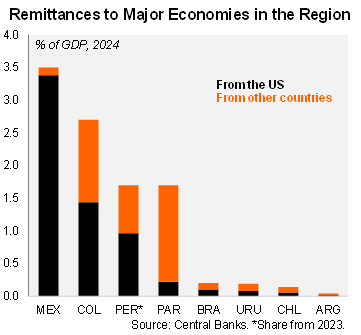

Remittance flows to Mexico and Colombia are sizable, most of which are sourced from the US. Still, the share of these outflows from remittance tax exempt US citizens / nationals is unclear. Even then, enforcement of the tax – as designed - seems challenging, and could have the undesired consequence of leading to greater outflows through unregulated platforms.

Our take: In the near term, remittance outflows from the US might be frontloaded, either to avoid the tax or due to higher perceived risks of deportation or more stringent enforcement on the migration front.

In our view, even though remittances from the US to some of the major economies in the region are sizable, overall macro effects of such an approved measure should be limited considering relevant implementation and enforcement challenges. Importantly, the implementation of such a measure would take place as current account deficits have narrowed. In contrast, swings in US trade and migration policy, the US business cycle, and shifts in the Fed’s policy rate path are a first order of concern for the region.