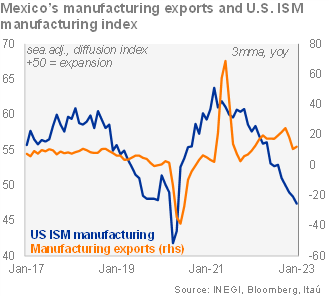

Manufacturing exports rebound is unlikely to last given a soft external scenario

Julio Ruiz

27/02/2023

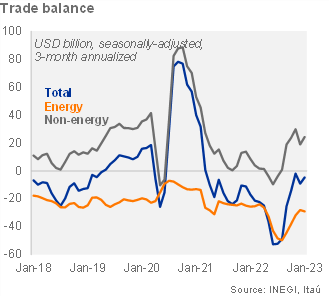

The trade balance posted a deficit of USD 4.1 billion in January, better than our forecast of a deficit of USD 5.9 billion and market consensus of a deficit of USD 4.8 billion (as per Bloomberg). The 12-month rolling trade balance stood at a deficit of USD 24.3 billion (from a deficit of USD 26.4 billion in 2022), supported by an improvement of the non-energy trade balance which stood at a surplus of USD 11.4 billion (from a surplus of USD 8.5 billion), while the energy deficit reached USD 35.6 billion (from a deficit of USD 34.9 billion). At the margin, using three-month annualized seasonally adjusted figures, the trade balance improved to a deficit of USD 4.7 billion in January (from a deficit of USD 9.1 billion in 4Q22), with the energy trade deficit at USD 28.9 billion (from a deficit of USD 28 billion), while the non-energy trade balance posted a surplus of USD 24.2 billion (from a surplus of USD 18.8 billion).

Manufacturing rebounded in January, but momentum remains weak. Using seasonally adjusted series, manufacturing exports posted a solid 7.1% mom, after registering three consecutive contractions in the previous months. The figure was supported by both vehicle (12.1%) and non-vehicle (4.5%) exports. Still, the quarter-over-quarter annualized growth rate (qoq/saar) for manufacturing exports stood at a weak -7.8% in January (from 8.2% in 4Q22).

Non-energy imports expanded in January supported by consumption goods. Also using seasonally adjusted figures, non-energy imports grew 1.5% mom, driven by consumption imports (posted a strong 19.1% expansion) which mitigated the contraction in intermediate and capital goods imports both of 0.6%. The qoq/saar growth rate of non-oil imports stood at -7.0% in January (from -8.2% in 4Q22).

We expect the trade deficit to deteriorate to USD 29 billion this year (from a deficit of USD 26.4 billion in 2022). The strong growth observed in manufacturing exports in January is unlikely to last given a soft global outlook, widening the trade deficit, which will be mitigated by a slower growth of non-energy imports as internal demand softens.

Julio Ruiz