Vittorio Peretti & Carolina Monzón

14/02/2023

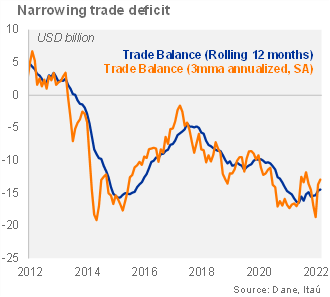

The trade deficit is gradually correcting as terms of trade remain favorable and domestic demand normalizes. In December, the trade deficit reached USD 0.9 billion, narrowing USD 0.2 billion from the close of 2021. The deficit was somewhat above both the Bloomberg market consensus and our USD 0.8 billion call. As a result, the rolling 12-month trade deficit reached USD 14.4 billion, down form USD 15.3 billion in 2021 (also USD 15.3 billion as of September). At the margin, the quarterly seasonally adjusted trade deficit reached USD 12.9 billion (annualized), narrowing from the USD 17 billion recorded in 3Q22, but still large given the favorable terms of trade.

Consumer goods imports fall. During 4Q22, imports contracted 2.9% yoy (32% in 3Q and 40% in 2Q22), while imports excluding fuels and transportation equipment contracted 8.5% yoy (+22% expansion in 3Q). At the margin, we estimate that imports fell 49.9% qoq/saar, down from the +3.4% registered in 3Q22 (+36.3% in 2Q22), as a weak COP, rising interest rates and high inflation stem domestic demand. For the full year, imports rose 26.1% (+37.5% in 2021).

Exports slow at the backend of 2022. Export growth moderated to 6.3% yoy in 4Q22 (from +41.9% in 3Q22 and 69.3% in 2Q22) as falling volumes dragged both coal and oil sales. Exports excluding traditional goods (oil, coal, coffee, and ferronickel) grew a mild 0.4% (10.5% in 3Q). At the margin, exports contracted 43.8% qoq/saar building on from the 25.0% decline in 3Q22, dragged by oil and coal exports. For the full year, exports rose 38% (+33% in 2021).

We estimate a current-account deficit of 6.7% of GDP in 2022 (5.7% in 2021). Looking ahead, still high oil prices, lower international shipping fees and the expected domestic demand slowdown would aid a CAD narrowing to 4.7% of GDP this year.

Vittorio Peretti

Carolina Monzón