Vittorio Peretti & Carolina Monzón

14/02/2023

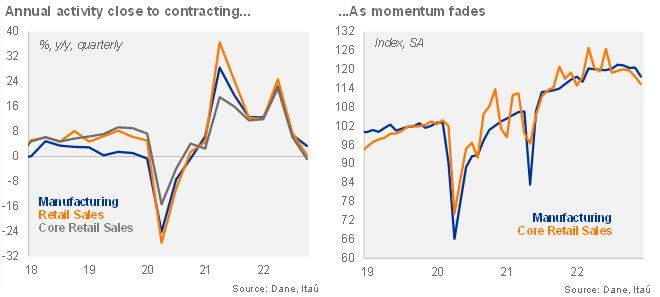

Activity closed 2022 on a weaker footing with both retail sales and manufacturing falling sequentially from November. Manufacturing fell 2.3% mom/sa, the third sequential fall since August. In annual terms, manufacturing increased 0.5% YoY (down from 14.0% in November), well below both the Bloomberg market consensus and our estimate of 3%. Meanwhile, core retail sales (excluding fuels and vehicles) dropped 2.1% mom/sa, building on the 1.6% drop in November. In annual terms, total retail sales contracted 1.8% YoY in December (+1.7% previously), below the +1% Bloomberg market expectation and our +0.5% forecast. Core retail sales dropped 2% YoY. Overall, we expect GDP growth of 3.7% in the final quarter of 2022 (to be released tomorrow; 7.0% in 3Q22), leading to growth of 8% during 2022 (10.7% in 2021). Nevertheless, risks tilt towards a swifter deceleration in 4Q22.

A weak final quarter of 2022 amid rising inflation and higher interest rates. During 4Q22, retail sales grew 0.5% yoy, moderating from 5.6% in 3Q22, while core retail sales contracted 0.8% yoy (6.3% in 3Q22). At the margin, core retail sales fell 6.3% qoq/saar (following a 8.3%decline in 3Q22). For the full year, retail sales expanded 10.2% yoy (17.9% in 2021). Core retail sales increased a still strong 8.8% yoy in 2022 after 11.9% expansion in 2021.

Manufacturing losing momentum. During the quarter, manufacturing increased 3.4% YoY, after expanding 7.0% in 3Q22 (22.4% in 2Q22). At the margin, manufacturing contracted 4.5% qoq/saar in the fourth quarter, from the 3.7% increase in 3Q22. Overall, manufacturing expanded 10.7% last year, moderating from the 16.1% increase in 2021.

We expect the economy to slow to 0.6% in 2023, from the 8.0% estimated for last year. Weak retail at the margin suggest that high inflation, a softening labor market, weak COP and higher interest rates are denting consumer purchasing power and leading to weaker private consumption. Elevated domestic policy uncertainty and a slowing activity will likely restrain investment ahead, thereby aiding the needed activity normalization.

Vittorio Peretti

Carolina Monzón