Consumer prices rose by 0.32% from March to April, exceeding the mild contraction registered last April and the 0.2% average over the prior decade. The April CPI came in above our 0.2% call (Bloomberg market consensus: 0.2%). Food prices remain the main price driver, as a prior heat affected production, and the Easter celebration boosted demand. The Food and Alcoholic Beverage category increased 0.94% (contributing 23bps to headline inflation). The Restaurant and Hotel division (0.2%; +3bps) and transportation (0.2%; +2bps) were the other main contributors. Excluding the volatile food and energy items, inflation was a milder 0.14% MoM.

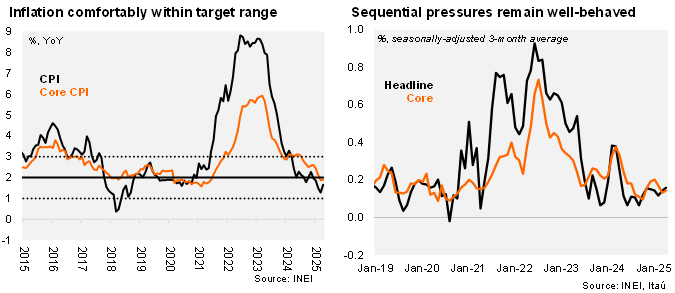

On an annual basis, inflation reached 1.65%, up from the base effect led 1.28% low in March. Overall, inflation remain comfortably within the BCRP’s range of 2% (+/- 1%) target. Headline inflation has stood within the target range for thirteen consecutive months. Core inflation (ex-food & energy) rose by 1.9% YoY (in line with the March print) and near a three-year low. Inflationary pressures at the margin are near the center of the target range.

Our take: We expect inflation to remain within the BCRP’s inflation target range through 2025 (2.3% yearend). With well-behaved inflation and inflation expectations, along with the anticipated deterioration of the global economic outlook and our forecast for Fed cuts, we expect the BCRP to cautiously resume its easing cycle. We anticipate two additional cuts of 25 basis points this year, bringing the rate to 4.25%.