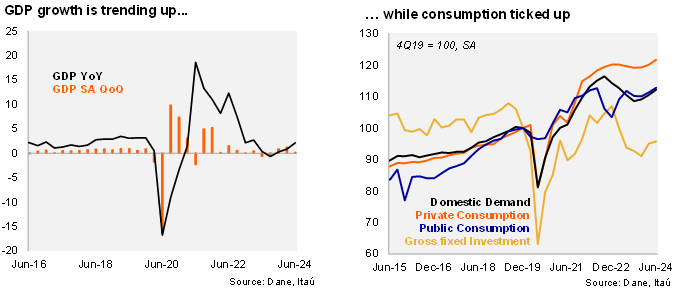

GDP surprised to the downside in 2Q24. Activity increased 2.1% YoY in 2Q24 (+0.8% in 1Q24), below the Bloomberg market consensus of 2.8% and our 2.7% call. While GDP surprised the market to the downside, the print was above BanRep's staff forecast of 1.8%. The annual GDP increase was boosted by net exports, while gross fixed investment gradually recovered from the previous quarters. Sequentially, the economy rose 0.1% (SA) from 1Q24 to 2Q24, primarily lifted by public administration, agriculture and financial and insurance activities. Although private consumption gradually improved, the GDP breakdown still does not reflect a significant domestic demand rebound.

Entertainment, agriculture and public administration pulled activity up in 2Q24, while manufacturing remained in negative territory. Entertainment rose 11.1% YoY (+7.9% in 1Q24), agriculture increased 10.2% YoY (+5.8% YoY in 1Q24) and public administration gained +4.8% (+5.5% in 1Q24). On the other hand, mining fell 3.3% (-1.6% in 1Q24), communications contracted 1.9% (-2.0% in 1Q24), and manufacturing dropped 1.6% YoY (-5.7% in 1Q24). Construction increased by 2.4% YoY (+0.6 in 1Q24), while commerce posted a small increase of 0.15%. Overall, the natural resource sector rose 4.7% YoY (+2.8% in 1Q24), while non-natural resource activity increased 1.8% YoY (+0.6% previously).

Gross fixed investment returned to positive territory, while consumption gradually recovered. Gross fixed investment increased 4.3% (-6.2% in 1Q24; -13.8% in 4Q23), after 5 continuous quarters of annual declines, due to a gradual recovery of machinery and equipment. Total consumption grew 1.6% YoY (+0.3% in 1Q24), lifted by public consumption of 2.0% (-0.8% in 1Q24) and private consumption of 1.5% (0.5% in 1Q24). Exports increased by 4.8% over one year (+1.5% in 1Q24), while after 5 months in negative territory, imports rose by 2.2% (-10.4% in 1Q24).

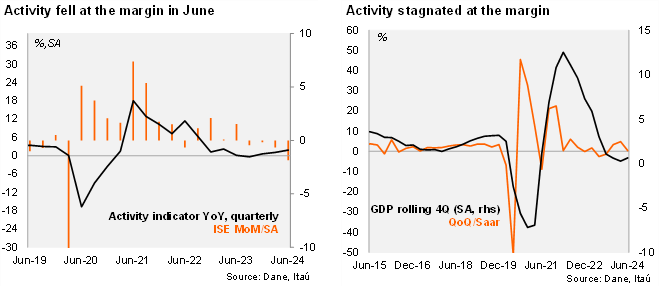

At the margin, activity increased 0.4% qoq/saar, below the 4.9% registered in 1Q24. The seasonal and calendar adjusted series shows that gross fixed investment increased +3.1% qoq/saar (below the +18.6% in the 1Q24). Private consumption grew 5.5% qoq/saar (+2.7% qoq/saar in 1Q24). Meanwhile, imports increased by 24.8% qoq/saar. The monthly coincident indicator (ISE) fell by 1.9% from May to June (SA), below the -0.5% in the previous month.

Our Take:Activity has been more resilient than expected, however key sectors such as manufacturing remain weak. We expect the economy to grow 1.6% in 2024 (from 0.6% in 2023), where the lagged effect of monetary policy and a disinflationary process that remains gradual will constrain any significant rebound of the activity. We expect BanRep to continue with a 50bp cut at the next monetary policy meeting in September as the activity result was above the expectations of the technical staff. However, rate cuts by the Fed during the latter part of the year along with a more pronounced acceleration of the disinflationary process and more anchored CPI expectations may open the door to an acceleration of the easing cycle.