2025/08/14 | Vittorio Peretti, Carolina Monzón, Juan Robayo & Angela Gonzalez

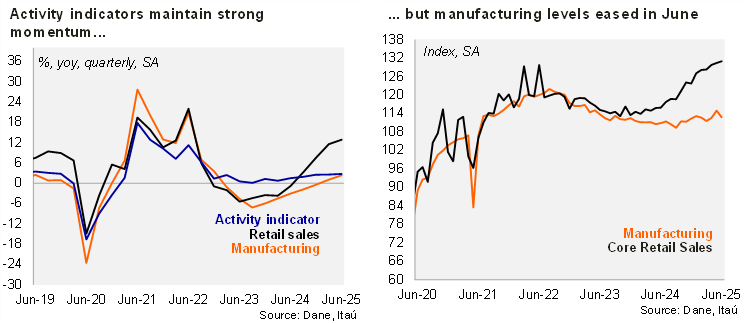

Retail sales and manufacturing growth remained upbeat but surprised the market to the downside in June. Retail sales rose by 10.1% YoY in June (+13.2% in May), below the Bloomberg market consensus of 11.6% and our 14% forecast. Core retail sales (excluding fuels and vehicles) increased 0.4% MoM/SA, leading to an 11.4% YoY rise (+14.5% previously). Meanwhile, manufacturing dropped by 1.9% MoM (+2.2% in the previous month), resulting in a +2.2% YoY increase (+3.1% in May), lower than the Bloomberg market consensus of +2.7% and our +3.1% forecast. As a result, the data places a downside bias to June's monthly activity indicator (ISE), to be released on August 15. We expect an annual increase of 4.1%, mainly driven by tertiary activities but partially offset by mining and manufacturing. Overall, we expect GDP growth of 2.9% in the second quarter of the year (also to be released on August 15).

Strong activity momentum in 2Q25. During the second quarter of the year, manufacturing increased 0.6% YoY ( down from +1.8% in 1Q25). At the margin, manufacturing rose by 3.6% QoQ/saar (up from a 2.6% increase in 1Q25). Moreover, retail sales increased by 11.6% YoY in 2Q25 ( up from +10.1% in 1Q25), while core retail sales rose 12.6% YoY (+10% in 1Q25). Sequentially core retail sales growth increased 8.3% QoQ/saar (from +16.5% in 1Q25).

Our take: We have an upside bias to our 2.5% growth call for this year, accelerating from 1.7% in 2024. A tight labor market, closed output gap and elevated inflation restrict the scope for rate cuts in Colombia.