2025/10/15 | Vittorio Peretti, Carolina Monzón, Juan Robayo & Angela Gonzalez

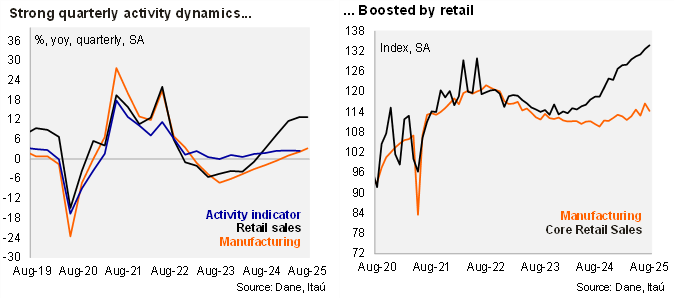

Retail sales and manufacturing remained strong in August, but underwhelmed relative to consensus. Retail sales rose by 12.4% YoY in real terms in August (+18% in July), below the Bloomberg market consensus of 13.2% YoY and our 14% call. Core retail sales (excluding fuels and vehicles) increased by 0.8% MoM/SA, leading to a 13.7% YoY rise in real terms (+13.3% previously). Meanwhile, manufacturing fell by 1.9% MoM/SA (+3.2% in the previous month), resulting in a 1.0% YoY increase (+5.8% in August), lower than the Bloomberg market consensus of 4.0% and our 4.6% call.

Upbeat activity dynamics in the quarter. During the quarter ending August, manufacturing increased by 3.0% YoY (+0.6% in the 2Q). At the margin, manufacturing increased by 5.6% qoq/saar, above the 3.3% in 2Q. Retail sales rose 13.5% YoY in the quarter (+11.6% in 2Q), while core retail sales increased by 12.8% YoY (+12.6% YoY in 2Q). Sequentially, core retail sales growth increased 8.7% QoQ/saar (from +5.6% QoQ/saar in 2Q25) driven by durable goods (mainly electronic appliances). It is worth noting vehicle sales continued to overperform with a 42% expansion during the quarter (vs 24% in 2Q).

Our Take: We expect the economy to grow 2.7% this year (above from the 1.6% in 2024). Private consumption, supported by the tight labor market and elevated real wage growth, is a key activity driver.