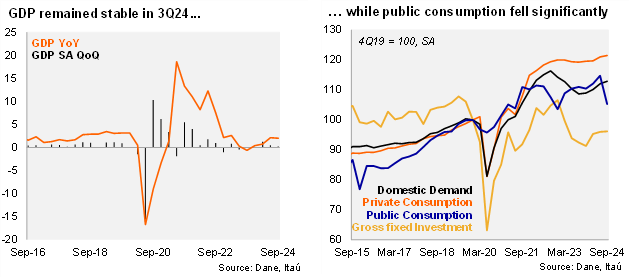

The Colombian economy grew below expectations during the third quarter of the year. Activity increased 2.0% YoY in 3Q24 (+2.1% in 2Q24), below the Bloomberg market consensus of 2.3%, and our 2.5% call. The GDP print was also inferior to the BanRep’s staff forecast of 2.4%. The annual GDP increase was boosted by net exports, while gross fixed investment gradually recovered from the previous quarters. Sequentially, the economy rose 0.2% (SA) from 2Q24 to 3Q24 (+0.5% previously), primarily lifted by agriculture, entertainment and financial and insurance activities. Even though private consumption improved, as was anticipated by the rebound in imports, key sectors such as manufacturing and mining remain weak.

Gross fixed investment continued a gradual recovery, while imports picked up significantly in line with consolidating private consumption dynamics. Gross fixed investment increased 4.0% YoY (+4.3% in 2Q24; -5.6% in 1Q24), due to a machinery and equipment pick-up. Total consumption grew by a mild +0.7% YoY (+1.8% in 2Q24), lifted by the private consumption rise of 1.6% (+1.2% in 2Q24) but countered by a public consumption adjustment of -4.3% (+4.8% in 2Q24). Exports increased by 3.8% over one year (+5.6% in 2Q24), while imports showed a significant acceleration to 11.0% (+3.0% in 2Q24). On the supply side, the natural resource sector rose 3.7% YoY (+4.9% in 2Q24), while non-natural resource activity increased by 1.9% (stable from the previous month).

At the margin, activity increased by 0.8% qoq/saar, slowing from the 2.0% registered in 2Q24. The seasonal and calendar adjusted series shows that gross fixed investment increased +0.8% qoq/saar (+2.8% in the 2Q24). Private consumption grew 1.5% qoq/saar (+4.5% qoq/saar in 2Q24). Meanwhile, imports increased by 10.3% qoq/saar (22.8% previously). The monthly coincident indicator (ISE) fell by 0.4% from August to September (SA), a second consecutive monthly decline. The monthly drop was explained by the transport strike. In fact, nine out of 12 activities posted sequential contractions, led by construction and industry (-1.6% MoM).

Our Take: Activity has shown signs of gradually recovering, although at an uneven pace across sectors. We expect the economy to grow 2.0% this year (0.6% in 2023), where the lagged effect of a monetary policy that continues to be contractionary and a gradual disinflationary process will restrict a more significant rebound in activity. Amid elevated internal fiscal noise and weak currency dynamics, we expect BanRep to maintain the 50bp rate cut pace at the next monetary policy meeting in December, despite pressure to accelerate.